There has been a tug of war going on in the markets lately. The free traders are worried about a trade war and average people are not too worried. The market is normally pretty flat during the summer months, sometimes called the summer doldrums. If you were to look back historically at how the market does in the summer, then you will find that it is pretty flat and goes through a lot of up and down volatility. This is a textbook example of what is happening this summer. Mostly sideways movement with volatile ups and downs.

Here we are again at the end of another quarter and I expect the next couple of days to be down, then buyers will come into the market on Monday of next week. Money managers do their window dressing near the end of a quarter, because of two reasons. One is that they want to lock in any gains and the other reason is to hide their portfolios from freeloaders who like to copy what they are doing.

I think what we will see is a good second half of the year as far as the economy is concerned and more of a bounce to the upside in the market in the 4th quarter as has been typical historically.

Stay focused, stay invested and you will be rewarded for it later in the year.

This Blog is the Opinion of Rick Allison, the Author of: Designing an Investment Portfolio for American Patriots. Rick's Registered Investment Adviser web site is located at: www.marianfs.com.

Showing posts with label Meet Wally Street. Show all posts

Showing posts with label Meet Wally Street. Show all posts

Wednesday, June 27, 2018

Thursday, February 18, 2016

Investment Realities

Well, it has finally happened. The stock market has pulled back enough to pretty much knock all major portfolio managers down to size. I just took a look at some of the largest and best portfolio managers in the country and their recent performance. Most of them have returned as of January 31, 2016, -8% for the last year, a return of around 2% for the last three years and around 4% over the last five years. This is rather eye opening, don't you agree?

What generally happens in these situations is that the clients of investment firms see these dismal numbers on their account statements and blame it on their financial advisor. What they normally do is move their accounts to another advisor thinking that this is going to make a difference. However, the brutal truth is that the likelihood of a new advisor to significantly outperform your last financial adviser is slim to none.

As much as it pains me to say it, you may be better off having a meeting with your financial advisor and letting them show you their market numbers for the last year, three years and five years. If their numbers are seriously out of whack from the numbers mentioned above, then you have good reason to move your accounts. However, if they have returned around 2% for the last three years and around 4% for the last five years, then they have been in a properly diversified portfolio of investments. I know this doesn't sound good, but it proves the point that leaving your financial adviser and moving to another one thinking your investment performance will improve significantly is really a fool's game.

If you really wanted to check up on how you are doing, then I have an idea for you. What if you could find a CFP® who could evaluate your investment performance for you without you having to move any of your investment accounts? In addition, what if this same CFP® could do this for the laughingly low fee of $500 per year?

Did you get that? You do not have to move any of your investment accounts and you have a highly qualified person to give your portfolio an annual look for only $500 per year. I call it Keep Your Assets. Take My Advice.™ Let someone, (that being me), be your overlay financial advisor and run a report on your accounts that shows you how you have done for the last one, three and five years. All I need is your account statements and I can go to work. You can even black out the account numbers. I don't need them to do my work.

Think of me as your financial quarterback directing the offense. If you are interested in a great service at a extraordinarily fair fee, then let me know and I will get to work on your behalf.

My Form ADV 2A Registered Investment Adviser disclosure and my background disclosure, Form 2B is available on my web site at http://www.marianfs.com on the bottom right of our home page.

Thanks.

What generally happens in these situations is that the clients of investment firms see these dismal numbers on their account statements and blame it on their financial advisor. What they normally do is move their accounts to another advisor thinking that this is going to make a difference. However, the brutal truth is that the likelihood of a new advisor to significantly outperform your last financial adviser is slim to none.

As much as it pains me to say it, you may be better off having a meeting with your financial advisor and letting them show you their market numbers for the last year, three years and five years. If their numbers are seriously out of whack from the numbers mentioned above, then you have good reason to move your accounts. However, if they have returned around 2% for the last three years and around 4% for the last five years, then they have been in a properly diversified portfolio of investments. I know this doesn't sound good, but it proves the point that leaving your financial adviser and moving to another one thinking your investment performance will improve significantly is really a fool's game.

If you really wanted to check up on how you are doing, then I have an idea for you. What if you could find a CFP® who could evaluate your investment performance for you without you having to move any of your investment accounts? In addition, what if this same CFP® could do this for the laughingly low fee of $500 per year?

Did you get that? You do not have to move any of your investment accounts and you have a highly qualified person to give your portfolio an annual look for only $500 per year. I call it Keep Your Assets. Take My Advice.™ Let someone, (that being me), be your overlay financial advisor and run a report on your accounts that shows you how you have done for the last one, three and five years. All I need is your account statements and I can go to work. You can even black out the account numbers. I don't need them to do my work.

Think of me as your financial quarterback directing the offense. If you are interested in a great service at a extraordinarily fair fee, then let me know and I will get to work on your behalf.

My Form ADV 2A Registered Investment Adviser disclosure and my background disclosure, Form 2B is available on my web site at http://www.marianfs.com on the bottom right of our home page.

Thanks.

Tuesday, November 24, 2015

Social Security Changes Slipped In By Congress

No one in our industry saw this coming. Apparently, we financial advisers have been doing too good of a job in regard to advising clients on Social Security distributions and when to take them. Congress has gone in and taken away two major, not minor, but major planning opportunities. One is the Restricted Application Strategy and the other is the File and Suspend Strategy. No sense describing them since they no longer exist. Might as well not muddy the water. Well, they don't exist for most people, unless you file in the next 6 months or so.The point is that you might want to have a conversation with your financial adviser if you plan on taking your Social Security in the next 6 months.

The good news is if you delay taking your Social Security benefits, then you can still earn 8% a year for each year that you delay up until age 70. If you are in good health and have another source of funds that you are making less than 8% guaranteed, then you might be better off delaying your Social Security benefits. However, I would advise speaking with a financial adviser (if not me) about it.

Happy Thanksgiving!

The good news is if you delay taking your Social Security benefits, then you can still earn 8% a year for each year that you delay up until age 70. If you are in good health and have another source of funds that you are making less than 8% guaranteed, then you might be better off delaying your Social Security benefits. However, I would advise speaking with a financial adviser (if not me) about it.

Happy Thanksgiving!

Thursday, August 27, 2015

Understanding Investing Risks

The last

several years has instilled into investors thinking a couple of major

fallacies. One is that when the markets start to go down, it is going to go way,

way down. The second is that another 2008 is right around the corner, even

though it is a once in 43 year occurrence. Both of these assumptions are wrong.

You have to understand that we now live in an instantaneous world. News travels

exceedingly fast and reacting to it just as fast, is totally foolish. I do not

mean to insult anyone, but it is important to say the truth.

Being invested

in hedge funds, alternatives, stocks, bonds, commodities, real estate, annuities,

CD's and cash has its risks and rewards. Let's look at these choices since they

each have pluses and minuses.

Hedge funds - What is a hedge fund anyway? There

are about a dozen different mainstream hedging strategies used today. They all

have one thing in common. They strive to reduce the risk in a portfolio. Let's

drill down further. Suppose you have a portfolio of 30 stocks. Unhedged, you

would be subject to the performance of those 30 stocks for as long as you held

them. A hedge fund may hold the same 30 stocks, but put a "hedge" on

to protect against a sudden downdraft in the stock market. However, by doing

so, it's upside performance is sacrificed. For example, if the hedging was done

by buying Put Options, then there is a cost to buy those 30 Put Options. If any

of those stocks do not go down as hedged against, then the performance of a 30

stock portfolio with Put Options would significantly under perform. A 30 stock

portfolio without the hedge would be better in that situation, than a 30 stock

portfolio with Put Options as a hedge. Don't you see? So, what we learn is the

risk to a hedge fund is when the market goes up.

Alternatives - Alternatives is kind of a broad term

these days, but it can include promissory notes, structured products, limited

partnerships, Regulation D offerings, private equity, non-publicly traded

investments like REIT's and Business Development Corporations (BDC's), currency

funds, physical gold, silver, platinum and other investments. The risk to these

can range from a lack of liquidity, inaccurate valuations and or pricing, Ponzi

scheme potential, lack of dividends, not to mention significantly more risk.

These investments are not appropriate for people with less than $1,000,000 net

worth or $200,000 per year in Adjusted Gross Income, in my opinion.

Stocks - Stocks on the other hand benefit when the market goes

up, but have the risk of a market sell off. This would include stock mutual

funds and ETF's, too. Historically, long term investors have always been

rewarded for holding onto stocks for five, ten and certainly twenty years or

more. The longer the holding period, the less risk there is to stocks.

Bonds - Bonds are touted as a safe investment by many. However,

they are subject to interest rate risk. When interest rates go down, bonds

benefit. However, when interest rates go up, they can lose money. It depends on

the maturity, the issuer, the rating and other factors, but in most cases bonds

will always be affected when interest rates rise.

Commodities - Commodities typically benefit from a

booming economy. Commodities need inflation to benefit. It is more sensitive to

supply and demand issues. Oil is a perfect example right now. When there is

less demand, the price falls. Oil was priced around 100 a barrel not very long

ago, but now is down around 60% from that. So, if you bought Oil at 100 a

barrel, then you could be down 60% roughly. So, your risk with Commodities is lack

of demand and over-supply.

Real Estate - Real Estate Agents always like to

tout real estate as one of the best places to put your money. It can be a good

place to put your money if you use other people's money to do it. There is no

doubt that it can be extraordinarily foolish to pay off your house. Read my

book, "Meet Wally Street. The ReasonYou're Stupid" for more on this.

Real estate is subject

to supply and demand, also. For example, in the 2008 crisis, there was way too

much demand coupled with people who bought homes at the top of the market

(over-priced.) When things are over-priced, they eventually correct back to a

median or more normal supply price. This was very painful for a lot of people

in America and some still have not recovered from it. Real estate is also

subject to interest rate risk. If you are invested in real estate via a mutual

fund or other investment and rates go up, then you are going to be negatively

impacted.

Annuities - Annuities are fully guaranteed by the

insurance company who issues them. I am talking about Fixed and Indexed

Annuities in particular. Variable Annuities have the same risks as Stocks, so I

am not discussing them here. I am only discussing Fixed and Indexed Annuities.

Fixed Annuities pay a fixed rate of interest. I received an interest rate

update from an insurance company today. A 5 year fixed annuity is paying 2.75%.

How does that sound to you? Yes it is guaranteed, but will you be satisfied

with a 2.75% growth rate for the next five years?

Indexed

Annuities pay interest based on several factors, but in a nutshell they are

tied to some kind of index and they return a percentage of that index to

policyholders each year. So, if the S&P 500 goes up, then you get a

percentage of that upside credited to your annuity policy. If the S&P 500

goes down, then you more than likely make a 1% or 0% return. That may not sound

all that great, but it is certainly better than losing 10% in the stock market,

is it not? The risk to these is that you will have years of 0% or 1% in some

years when the stock market is down.

CD's - CD's are fully insured by the FDIC, but today's CD rates

are paltry to say the least. A 3 month CD may pay about 0.25% annualized. Not a

lot to write home to momma about. The risk to CD's is little or no income and

lack of principal growth.

Cash - Cash or money market funds have some risk to them, but

it depends on where you have your money market fund. If it is a FDIC insured

bank account, then you are safer than with a mutual fund money market. Rates on

money markets are about 0.02% right now. The Federal Reserve has basically

stolen from average investors in order to allow the major banks to recapitalize

after the 2008 Great Recession. Is this fair? Of course not, but what can we do

about it? Not a whole lot, unfortunately.

Where do you invest knowing these risks?

There you have

it. Those are your major choices. Which of those is the best place to invest? Should

you put all your money into one of these? That might be rather foolish.

Instead, perhaps you

may want to be in most or all of those areas, because you never know which one

is the right place to be from year to year. This is called being diversified.

This is what we

do. We don't react to every piece of frightening news on television, nor to the

endless stream of pundits and hucksters who preach doom and gloom. If you are

smart, then you will quit watching television and let your diversified

portfolio go to work for you. Sure, there will be times when markets pull back,

but over the long haul you will be rewarded.

- Have we been rewarded because I made the decision in January of this year to eliminate Emerging Markets from our portfolios? Yes we have, but it might have gone unnoticed.

- Have we been rewarded for removing High Yield from our portfolios? Yes we have, but again it has probably gone unnoticed.

- Have we been rewarded for have about 0.52% of our portfolio in China? Yes we have but again it has most likely gone unnoticed.

- Have we been rewarded for getting out of Gold at $250 an ounce higher than where it is trading today? Yes, but this fact too has probably gone unnoticed.

When you wonder

why we haven't done anything in the last week perhaps you might consider my

four points above. The fifth point is that we are on top of things even if you

do not believe that we are. We will make adjustments when we feel they are warranted.

As of today, doing nothing in the last week looks to be a pretty good decision

in my book.

Stay focused,

stay diversified and stay away from emotional decisions based on the television

news. Remember this key point. It never feels good to be invested. Something is

always going on to affect one or more of the above investments. Always!

You must understand that it never feels good to be invested in any

market.

The goal is to

have a plan, a process and a professional. I call this the three P's. That is

what you have if you are a client of ours and you take our advice! I have

trademarked a phrase that is apropos. Keep Your Assets. Take My Advice®.

Interpreted to mean if you want to keep your assets, then take my advice.

Thank you for being

a client and if you are not a client, then perhaps you might want to be.

Monday, April 6, 2015

ETF Portfolio Review

The S&P 500 was pretty flat for the first quarter of 2015. Personally, I do not like comparisons against the S&P 500 and our ETF Portfolios, because they do not account for risk adjusted returns, dividends and equity allocation percentages. The S&P 500 is an index of the nation's top 500 U.S. companies. It is 100% allocated to equities or stocks. For the first quarter of this year, it ended up at 2,067.89. It started the year at 2,058.20. This represents a growth in points of 9.69 and a very meager return of 0.47%.

If you happened to be considering investing in an S&P 500 index fund right now and you found out that the first quarter of 2015 only returned 0.47%, then would you still invest in it? Not with all of your money, but a portion? This is the mistake that most investors make in regard to investing. They will look at the performance of a particular fund which represents a recent time period, then decide based on that limited information whether to invest in it or not. Then, they repeat this process for several positions. In the end, they may have a dozen different positions that they have chosen based on "good" past performance. The problem with this is that they have not analyzed the overall 12 positions to see how they will react together.

Anytime that you put a portfolio of positions together and make a "good" portfolio out of them, then there are several other things that need to go into your analysis. First of all, what level of risk are you taking? What is the standard deviation? What was it in 2008 the year of the big crash? What is it today? What is the Beta today? What was it in 2008? What is the Alpha today? What was it in 2008? Did you know that these figures can changed drastically from year to year?

Just like performance changes from year to year, so does the statistics of Standard Deviation, Beta, Alpha, R-squared, Sharpe Ratio and others. Don't forget other important items like Credit Quality of the Fixed Income portion of the portfolio, assuming you have a Fixed Income portion. How many are AAA rated? AA rated? A rated? Junk rated? What about the duration of your Fixed Income portion? What is the Maturity of the Fixed Income portion?

Of course, don't forget about valuation multiples of the stocks like Price/Earnings, Price/Book, Price/Sales and Price/Cash Flow. Then, there is profitability of the stocks in the portfolio. What is the Net Profit Margin? Return on Equity? Return on Assets? How much is their Debt to Capital Ratio? What about Potential Capital Gains Tax exposure? What about the overall expense ratio?

I can tell you all of the above in regard to our portfolios, but I doubt any self-directed investor could do the same. Most people who invest on their own do very poorly. Hiring a professional advisor who not only knows how to invest, but also is a financial planner, real estate agent and insurance agent just might make more sense than trying to invest on your own.

When you look at becoming a client with our firm, we educate you on all the items described above. You will know how your current portfolio looks and what you can expect from it if you did nothing. Then, we will show you how to improve it with our professional expertise. It is simple really. You can continue to kid yourself into thinking that you are just as competent as a professional like me, or you can realize that hiring a professional like me is a very smart decision. The choice is all yours.

Please visit one or both of my web sites. Marian Financial Services, Inc. or for First Coast Planning, LLC.

If you happened to be considering investing in an S&P 500 index fund right now and you found out that the first quarter of 2015 only returned 0.47%, then would you still invest in it? Not with all of your money, but a portion? This is the mistake that most investors make in regard to investing. They will look at the performance of a particular fund which represents a recent time period, then decide based on that limited information whether to invest in it or not. Then, they repeat this process for several positions. In the end, they may have a dozen different positions that they have chosen based on "good" past performance. The problem with this is that they have not analyzed the overall 12 positions to see how they will react together.

Anytime that you put a portfolio of positions together and make a "good" portfolio out of them, then there are several other things that need to go into your analysis. First of all, what level of risk are you taking? What is the standard deviation? What was it in 2008 the year of the big crash? What is it today? What is the Beta today? What was it in 2008? What is the Alpha today? What was it in 2008? Did you know that these figures can changed drastically from year to year?

Just like performance changes from year to year, so does the statistics of Standard Deviation, Beta, Alpha, R-squared, Sharpe Ratio and others. Don't forget other important items like Credit Quality of the Fixed Income portion of the portfolio, assuming you have a Fixed Income portion. How many are AAA rated? AA rated? A rated? Junk rated? What about the duration of your Fixed Income portion? What is the Maturity of the Fixed Income portion?

Of course, don't forget about valuation multiples of the stocks like Price/Earnings, Price/Book, Price/Sales and Price/Cash Flow. Then, there is profitability of the stocks in the portfolio. What is the Net Profit Margin? Return on Equity? Return on Assets? How much is their Debt to Capital Ratio? What about Potential Capital Gains Tax exposure? What about the overall expense ratio?

I can tell you all of the above in regard to our portfolios, but I doubt any self-directed investor could do the same. Most people who invest on their own do very poorly. Hiring a professional advisor who not only knows how to invest, but also is a financial planner, real estate agent and insurance agent just might make more sense than trying to invest on your own.

When you look at becoming a client with our firm, we educate you on all the items described above. You will know how your current portfolio looks and what you can expect from it if you did nothing. Then, we will show you how to improve it with our professional expertise. It is simple really. You can continue to kid yourself into thinking that you are just as competent as a professional like me, or you can realize that hiring a professional like me is a very smart decision. The choice is all yours.

Please visit one or both of my web sites. Marian Financial Services, Inc. or for First Coast Planning, LLC.

Tuesday, March 31, 2015

First Quarter of 2015 Ends Flat - Oil Down

There were lots of ups and downs this quarter in the stock markets. Reviewing some research from S&P, Morningstar, Ned Davis Research and others, we have noticed that stocks overall are in a muddling range. This means that they are beginning to get overvalued on a P/E basis, but that is based on last quarter's earnings. We really haven't had the full impact of lower oil prices on our economy. Lower oil prices have created some extra cash flow for consumers, but the compounding effect or the length of time that oil prices remain low is what matters. Businesses who are dependent on energy prices will also benefit and that should positively impact their earnings. Think trucking companies, airlines, shipping and the automobile industry.

When we as consumers receive week after week of low gasoline prices, then it will eventually show up as free cash flow to us. Depending on how often you fill up will determine the excess cash flow that you retain. Depending on the number of automobiles in your household (that you are paying for) determines your free cash flow. A typical two car family might see $120 to $150 per month in extra cash flow. When you multiply this out by each American household, then you can see how quickly this will multiply. Add month after month of this type of savings and you will eventually spur economic growth. There is little doubt about this fact.

Now consider the businesses who rely on gasoline like trucking firms. They could be saving $120 to $150 a week per truck. Multiply that times their entire fleet, then you can see a clearer picture. This will positively impact their bottom lines over time. As a result, even though stocks might appear overvalued a little bit right now, I believe that this will correct itself after earnings are released.

The underlying geopolitical issue going on here in my humble opinion is that Saudi Arabia had a plan of keeping their production high to try and cause Iran major pain. However, with this nuclear agreement between the U.S. and Iran, this has changed the impact that Saudi Arabia may have by keeping production high. If some deal is reached, no matter the deal, then the likelihood is that Iran will be free to sell their oil again. This will give them much needed cash flow for their economy and the Saudi's plan will no longer be much of an impact to Iran.

I suspect that oil prices may continue to decline a little bit more and may even dip down in the thirty dollar range, but after that happens, I expect a vigorous snap back. In other words, I think we will see a quick drop down, then an equally quick pop back up. The OPEC members will have had enough and they will cut production at that point and or shut refinery operations until they get their price of oil back up to a reasonable range for profits.

So, enjoy the low gas prices while you can. I suspect by the third or fourth quarter we will see gas prices trend back up.

When we as consumers receive week after week of low gasoline prices, then it will eventually show up as free cash flow to us. Depending on how often you fill up will determine the excess cash flow that you retain. Depending on the number of automobiles in your household (that you are paying for) determines your free cash flow. A typical two car family might see $120 to $150 per month in extra cash flow. When you multiply this out by each American household, then you can see how quickly this will multiply. Add month after month of this type of savings and you will eventually spur economic growth. There is little doubt about this fact.

Now consider the businesses who rely on gasoline like trucking firms. They could be saving $120 to $150 a week per truck. Multiply that times their entire fleet, then you can see a clearer picture. This will positively impact their bottom lines over time. As a result, even though stocks might appear overvalued a little bit right now, I believe that this will correct itself after earnings are released.

The underlying geopolitical issue going on here in my humble opinion is that Saudi Arabia had a plan of keeping their production high to try and cause Iran major pain. However, with this nuclear agreement between the U.S. and Iran, this has changed the impact that Saudi Arabia may have by keeping production high. If some deal is reached, no matter the deal, then the likelihood is that Iran will be free to sell their oil again. This will give them much needed cash flow for their economy and the Saudi's plan will no longer be much of an impact to Iran.

I suspect that oil prices may continue to decline a little bit more and may even dip down in the thirty dollar range, but after that happens, I expect a vigorous snap back. In other words, I think we will see a quick drop down, then an equally quick pop back up. The OPEC members will have had enough and they will cut production at that point and or shut refinery operations until they get their price of oil back up to a reasonable range for profits.

So, enjoy the low gas prices while you can. I suspect by the third or fourth quarter we will see gas prices trend back up.

Monday, February 9, 2015

Good Advice for $3.99

Looking back at some of the advice that I wrote about in Meet Wally Street - The Reason You're Stupid has turned out to be right on the mark. One of the main things that I tell people not to invest in are Non-Publicly Traded REIT's. Lo and behold, a major Non-Publicly Traded REIT overstated their income by about $23,000,000 last year. Their CEO had to resign and shareholders were left holding the bag. As I describe in my book, these are investments created by Wall Street to benefit the people who work for the Non-Publicly Traded REIT, not you. That's a fact, Jack.

It is the wild, wild west as far as regulations go with these Non-Publicly Traded REIT's. They ordinarily price the REIT themselves. You see, it really doesn't matter what they say the price is, because you are not going to be able to get your money out of it for at least 10 years anyway. Investors in Non-Publicly Traded REIT's sink their money into an illiquid investment for 10 years or more where they send you phony valuation statements all along, then later you might get a small portion of your money back if you are lucky. Let's see. The guy who sold you the damn thing makes off with 8.5% in commissions. The General Partners make off with another 11 - 13% right off the top, so you are already down 20% from day one. Not to worry, these guys running this REIT have lots of experience in Real Estate. This actually means that they are good at pulling the wool over people's eyes and taking their money. Are you one of them? I hope not.

FINRA, the organization who regulates the Non-Publicly Traded REIT industry has some good tips on their web site. This amounts to an Investor Alert that you should read. Who reads or knows about these tips from FINRA? Did you know that FINRA issues these investor alerts? That's what I thought. Here is the link by the way: FINRA Tip Sheet on REIT's.

I'm telling you. Investing $3.99 for a copy of my eBook is a great investment in your future. You can buy it here: Meet Wally Street. If you read it, then you will be better educated about what is really going on in regard to financial advice. I trust that you do read it. You'll be smarter for it.

It is the wild, wild west as far as regulations go with these Non-Publicly Traded REIT's. They ordinarily price the REIT themselves. You see, it really doesn't matter what they say the price is, because you are not going to be able to get your money out of it for at least 10 years anyway. Investors in Non-Publicly Traded REIT's sink their money into an illiquid investment for 10 years or more where they send you phony valuation statements all along, then later you might get a small portion of your money back if you are lucky. Let's see. The guy who sold you the damn thing makes off with 8.5% in commissions. The General Partners make off with another 11 - 13% right off the top, so you are already down 20% from day one. Not to worry, these guys running this REIT have lots of experience in Real Estate. This actually means that they are good at pulling the wool over people's eyes and taking their money. Are you one of them? I hope not.

FINRA, the organization who regulates the Non-Publicly Traded REIT industry has some good tips on their web site. This amounts to an Investor Alert that you should read. Who reads or knows about these tips from FINRA? Did you know that FINRA issues these investor alerts? That's what I thought. Here is the link by the way: FINRA Tip Sheet on REIT's.

I'm telling you. Investing $3.99 for a copy of my eBook is a great investment in your future. You can buy it here: Meet Wally Street. If you read it, then you will be better educated about what is really going on in regard to financial advice. I trust that you do read it. You'll be smarter for it.

Wednesday, December 10, 2014

Seniors Living Alone are at Risk

I recently heard about something very scary in relation to an 80 year old man living alone. A couple knocked on the door saying they were friends of a neighbor and wanted to come in and see his antiques. Once inside they scoured the home for valuables. They questioned the man about what was going to happen to his antiques and other possessions once he died, which is totally inappropriate. They kept asking probing questions about how much the antiques were worth, where do the family members live and who is he leaving these to in his will. After he finally got them to leave, he called the neighbor and asked if she knew them and she said she wasn't sure, but their name seemed familiar.

The next day, the man received a call from someone claiming to be his granddaughter who wanted money of course. The man realized it was a scam and hung up, since he didn't have any granddaughters.

There are several things to be aware of here. One is that those people could have knocked this elderly man in the head and taken whatever they wanted, or worse killed him. He should have never let them inside since he didn't know them.

Second, they could be setting him up for a break-in later, now that they know the layout of the home. They could be watching his house looking for him to leave and swoop in and steal whatever they wanted.

Further, these scammers could easily find out who lives in the neighborhood and pick out an equally elderly neighbor that they might rely on for a faint memory. They simply act as if they know the neighbor when in fact they just "googled" the neighbor and got their name figuring the elderly man would know the close neighbor. In reality, the neighbor doesn't know them at all.

Finally, they could be in cahoots with the supposed granddaughter who called the next day. The fact that this call was the very next day after this couple's visit was pretty suspicious.

It is hard to believe that there are people like this who prey on the elderly, but sadly there are way too many of them. If you have elderly family of friends, then make sure you check on them often and report any suspicious activity to the police.

The next day, the man received a call from someone claiming to be his granddaughter who wanted money of course. The man realized it was a scam and hung up, since he didn't have any granddaughters.

There are several things to be aware of here. One is that those people could have knocked this elderly man in the head and taken whatever they wanted, or worse killed him. He should have never let them inside since he didn't know them.

Second, they could be setting him up for a break-in later, now that they know the layout of the home. They could be watching his house looking for him to leave and swoop in and steal whatever they wanted.

Further, these scammers could easily find out who lives in the neighborhood and pick out an equally elderly neighbor that they might rely on for a faint memory. They simply act as if they know the neighbor when in fact they just "googled" the neighbor and got their name figuring the elderly man would know the close neighbor. In reality, the neighbor doesn't know them at all.

Finally, they could be in cahoots with the supposed granddaughter who called the next day. The fact that this call was the very next day after this couple's visit was pretty suspicious.

It is hard to believe that there are people like this who prey on the elderly, but sadly there are way too many of them. If you have elderly family of friends, then make sure you check on them often and report any suspicious activity to the police.

Monday, December 8, 2014

Just Like I Wrote It

The other day, I went into one of the major banks where I had opened an estate account for a client who passed away. We took care of everything for the client and their beneficiaries and I needed to close the account. I had originally considered opening this account with Schwab, but their review process would have taken three weeks and we needed to close on some real estate sooner than that, so I was forced to go to one of the major banks.

Just so happens, we have some personal accounts at this bank and when I sat down to close the account, the lady tried to sell me everything under the sun. This major bank doesn't do personal loans any more, but they will gladly give you a credit card. She tried to get me to open a credit card account.

I said "No thanks."

Then she tried to get me to take cash out of one of my credit card accounts.

"Why the hell do I want to run up my credit card bill?", I thought to myself.

I said "No thanks."

Then, she tried to get me to refinance my home equity loan for about 1.5% higher than my current rate.

Again, I said "No thanks."

Then, she tried to get me to refinance my home loan which was about 1% higher than my current rate.

"No!", I said.

She finally gave up and closed the account after wasting about 10 minutes of my time. She could tell I was getting perturbed.

This is the typical experience at a major bank today. I hate the damn bank and everything it represents. I would not even have the credit card at this bank if it wasn't for the bank buying my former credit card company. I never even opened the credit card with this bank. They just forced me into their devilish den. I may have to move that credit card account now after that fiasco.

While she was giving me this sales pitch, I couldn't help but notice an older man in the back office with a young stockbroker from a major brokerage firm that just so happens to be owned by the bank. Imagine that. This poor man was around 70 years old and he was doing business in the absolute worst place possible.

Hadn't he read my book? Of course he hasn't. Otherwise, he would have never set foot in that guy's office.

Doesn't he know that these stockbroker's are in business to generate the most revenue possible from him?

Why on earth would you ever do business with a bank owned brokerage firm?

It is so asinine. I am sure that if I reviewed this guy's investment statements, I would see variable annuities, loaded mutual funds, non-publicly traded REIT's and UIT's. Why? Because these are the products that make the bank the most money!

If you do your investment business with a bank or a bank owned brokerage firm, then STOP IT!!! They are ripping you off. For proof, all you have to do is look at your own statements. If you own variable annuities, loaded mutual funds, non-publicly traded REIT's and UIT's, then congratulations you been had. I'm sorry to be so blunt, but you need to wise up and quit letting these people rip you off.

When I went into this bank to close it out, I knew what to expect. I knew they would try and sell me everything under the sun. The poor old man was getting his head taken off in commissions and lack of liquidity and for what? I will tell you for what. The profits of the bank. They don't give a flying you know what about their clients. I don't care what line of BS you hear or what frilly commercials you see on television. They are in business to make as much money as they can off of you. Don't you ever forget it.

The only place to do your investment business is with an Independent Registered Investment Adviser who is not affiliated with a bank, brokerage firm or insurance company.

Of course, when little unknown guys like me write books, it is so hard to get any traction on book sales unless you are somebody famous. In my opinion, if a book does something to help you, then it doesn't make a hill of beans who wrote it. What may surprise people to know is that my book, "Meet Wally Street. The Reason You're Stupid." would have warned the 70 year old gentlemen never to do business with a bank owned brokerage firm period. In other words, it would have helped him!

I described this exact scenario to watch out for in my book. This is how it always is with me. I will write about something and read about other people's horror stories describing it later. Except in this case, I saw it with my own two eyes. It was sad to see let me tell you. I feel sorry for that elderly gentleman.

If you want a Christmas gift idea, then give people my book. You will save them a lot of money and headaches. It is only $3.99 on electronic devices and only $19.99 if you are old fashioned and want a real book. That's a bargain compared to the money that you will save them.

Merry Christmas to you and yours.

Just so happens, we have some personal accounts at this bank and when I sat down to close the account, the lady tried to sell me everything under the sun. This major bank doesn't do personal loans any more, but they will gladly give you a credit card. She tried to get me to open a credit card account.

I said "No thanks."

Then she tried to get me to take cash out of one of my credit card accounts.

"Why the hell do I want to run up my credit card bill?", I thought to myself.

I said "No thanks."

Then, she tried to get me to refinance my home equity loan for about 1.5% higher than my current rate.

Again, I said "No thanks."

Then, she tried to get me to refinance my home loan which was about 1% higher than my current rate.

"No!", I said.

She finally gave up and closed the account after wasting about 10 minutes of my time. She could tell I was getting perturbed.

This is the typical experience at a major bank today. I hate the damn bank and everything it represents. I would not even have the credit card at this bank if it wasn't for the bank buying my former credit card company. I never even opened the credit card with this bank. They just forced me into their devilish den. I may have to move that credit card account now after that fiasco.

While she was giving me this sales pitch, I couldn't help but notice an older man in the back office with a young stockbroker from a major brokerage firm that just so happens to be owned by the bank. Imagine that. This poor man was around 70 years old and he was doing business in the absolute worst place possible.

Hadn't he read my book? Of course he hasn't. Otherwise, he would have never set foot in that guy's office.

Doesn't he know that these stockbroker's are in business to generate the most revenue possible from him?

Why on earth would you ever do business with a bank owned brokerage firm?

It is so asinine. I am sure that if I reviewed this guy's investment statements, I would see variable annuities, loaded mutual funds, non-publicly traded REIT's and UIT's. Why? Because these are the products that make the bank the most money!

If you do your investment business with a bank or a bank owned brokerage firm, then STOP IT!!! They are ripping you off. For proof, all you have to do is look at your own statements. If you own variable annuities, loaded mutual funds, non-publicly traded REIT's and UIT's, then congratulations you been had. I'm sorry to be so blunt, but you need to wise up and quit letting these people rip you off.

When I went into this bank to close it out, I knew what to expect. I knew they would try and sell me everything under the sun. The poor old man was getting his head taken off in commissions and lack of liquidity and for what? I will tell you for what. The profits of the bank. They don't give a flying you know what about their clients. I don't care what line of BS you hear or what frilly commercials you see on television. They are in business to make as much money as they can off of you. Don't you ever forget it.

The only place to do your investment business is with an Independent Registered Investment Adviser who is not affiliated with a bank, brokerage firm or insurance company.

Of course, when little unknown guys like me write books, it is so hard to get any traction on book sales unless you are somebody famous. In my opinion, if a book does something to help you, then it doesn't make a hill of beans who wrote it. What may surprise people to know is that my book, "Meet Wally Street. The Reason You're Stupid." would have warned the 70 year old gentlemen never to do business with a bank owned brokerage firm period. In other words, it would have helped him!

I described this exact scenario to watch out for in my book. This is how it always is with me. I will write about something and read about other people's horror stories describing it later. Except in this case, I saw it with my own two eyes. It was sad to see let me tell you. I feel sorry for that elderly gentleman.

If you want a Christmas gift idea, then give people my book. You will save them a lot of money and headaches. It is only $3.99 on electronic devices and only $19.99 if you are old fashioned and want a real book. That's a bargain compared to the money that you will save them.

Merry Christmas to you and yours.

Tuesday, September 30, 2014

What's Your Viewpoint?

The other day, I was thinking about something that has never happened to me personally. I have never been fired from a job in my life. Going all the way back to my first job slopping food at the local hospital through today. What struck me about it was the fact that I have no idea what it is like to be fired. I have been on the other side of the table however. I have been the one doing the firing. In fact, over my lifetime, I have fired several people. Of course, I am sure that I was the villain in each of the firings from the point of view of the person being fired. However, they would be wrong, because I never fired anyone who did not deserve to be fired. Most of the time, it boiled down to two or three issues.

For what it is worth, I wanted to give some advice on this subject of being fired or laid off. If you believe in God, then you have heard the quote from the Bible that "God has a plan for you". Forgive me for paraphrasing. The burning question is do you believe this? I mean do you really believe this?

If you were fired or laid off and if you immediately get mad, blame others, refuse to accept any responsibility for it, then you do not believe that God has a plan for you. It is a question of faith. You lack faith. There is no disputing it either.

On the other hand, if you look at it as part of God's plan for you, then you will realize that there are other things that you are meant to do. If so, then why spend another day at that old job? If your faith lends you to believe in God's plan for you, then you will never get mad, blame others, nor refuse to accept responsibility for your actions. Instead, you will rejoice at the new opportunity in front of you.

There are really just two ways to handle being fired or laid off. Dwell in the house of despair and dysfunction or look forward to great things.

- They failed to show up for work regularly;

- They failed to come anywhere near their performance metrics; or

- They were stealing something from the company.

For what it is worth, I wanted to give some advice on this subject of being fired or laid off. If you believe in God, then you have heard the quote from the Bible that "God has a plan for you". Forgive me for paraphrasing. The burning question is do you believe this? I mean do you really believe this?

If you were fired or laid off and if you immediately get mad, blame others, refuse to accept any responsibility for it, then you do not believe that God has a plan for you. It is a question of faith. You lack faith. There is no disputing it either.

On the other hand, if you look at it as part of God's plan for you, then you will realize that there are other things that you are meant to do. If so, then why spend another day at that old job? If your faith lends you to believe in God's plan for you, then you will never get mad, blame others, nor refuse to accept responsibility for your actions. Instead, you will rejoice at the new opportunity in front of you.

There are really just two ways to handle being fired or laid off. Dwell in the house of despair and dysfunction or look forward to great things.

Wednesday, September 24, 2014

Legal Zoom Effect

Did Legal Zoom replace estate planning attorneys? Not hardly, but they did make life difficult for them. I can remember about 10 years ago when attorneys were getting as much as $5,000 for a revocable living trust with all the ancillary documents. Today, I think most attorneys will charge somewhere in the $1,000 to $2,000 range for the same services. A lot of attorneys will not waste their time for anything less than $1,000. It is simply not worth it to them. Legal Zoom had a fee compression effect on attorneys' fees.

I have a story in my book, Meet Wally Street, The Reason You're Stupid about people who use online legal document preparation firms. What most people do not think about when they use these online legal document preparation firms is that all they are doing is part of the equation. Yes, they are creating the documents at a discounted price from most attorneys, but they are failing to consider a lot of factors in their decision. One of those being...

How do you know the documents that you created online are going to work in your state and county? You can never be sure until you actually try and use them in a legal situation. I cannot tell you how many times that I have seen people prepare legal documents via some online legal document preparation firm and fail to dot an "i" or cross a "t". Most all of the mistakes that I see are in two main areas.

1) They fail to give the trustee the right powers; and

2) They fail to update their legal documents due to their death or disability of their trustees, successor trustees or beneficiaries.

Let me give you an example to ponder as to why you should always use an estate planning and an elder law attorney to draft and update your legal documents. This is an example of a lady who only had a will that she created online and never updated it.

In this example, an elderly man's unmarried adult daughter passes away with only a will that she created online. Her beneficiaries included her elderly father in addition to her two siblings. At the time the will was written, the elderly father was in good health. Fast forward a few years and the adult daughter gets ill with cancer and eventually succumbs to it and dies. While she was dying of cancer, her elderly father goes into a nursing home with dementia. The elderly father had a will leaving everything to his three children one of which just passed away. Now what?

Well, since the elderly father is now not legally competent and he doesn't have someone appointed by the court to handle his affairs, then someone has to go hire an attorney for him to obtain his share of his adult daughters estate which will have to go this route to get back to the two living siblings. Since the elderly father is in the nursing home with dementia, he is burning through all of his cash and runs out of all his cash. He didn't believe in Long Term Care Insurance. He sure could use the proceeds from his adult daughter's estate to help pay his nursing home costs, but unfortunately he has to have a legal guardian or conservator appointed first.

Meanwhile, while that is going on, the elderly father suddenly passes away. So, now the money from the adult daughter cannot be paid until her elderly father's estate goes through the probate process. The nursing home had to advise the family that they needed an attorney to get him qualified for Medicaid towards the end of his life. Nursing homes cost around $6,000 to $7,000 per month. If Medicaid pays it, then they want their money back when they can get it. In this case, Medicaid wanted their share of the proceeds of the adult daughter's estate! You see the elderly father ran out of funds while he was in the nursing home and had to go on Medicaid for about a year.

Now, the other siblings who thought they were the beneficiaries of their sister's and their elderly father's estates are going to get nothing from their father's estate. It is all going to pay back Medicaid and the probate attorney who had to step in and clean up this mess. Plus, they had to use some of the money that they inherited from their sister to pay for the attorney for their dad's guardianship, then later his estate and his burial, too. He didn't believe in life insurance either.

The moral of this story is that there are several things that could have happened to preserve family assets. The adult daughter could have hired an attorney to update her legal documents with a revocable living trust and keep them updated. In that document, it would have provided for contingencies. Anytime someone gets a serious illness, then those legal documents should be reviewed immediately. In addition, an elder law attorney could have saved most of the elderly father's estate with proper planning in advance. Further, the money from the sister's estate could have bypassed her elderly father's estate entirely once he went into the nursing home and gone directly to the two remaining siblings instead. However, one-third of their sister's estate which should have ended up with the two surviving siblings was gone like the wind to Medicaid.

Like I say in my book, estate planning and elder law attorneys are worth every single cent you pay them. The same cannot be said for doing your legal documents online and never updating them.

Do you realize that I may have just saved your family tens if not hundreds of thousands of dollars by telling you this? And, you thought that I was just another financial advisor.

I have a story in my book, Meet Wally Street, The Reason You're Stupid about people who use online legal document preparation firms. What most people do not think about when they use these online legal document preparation firms is that all they are doing is part of the equation. Yes, they are creating the documents at a discounted price from most attorneys, but they are failing to consider a lot of factors in their decision. One of those being...

Is this going to work?

How do you know the documents that you created online are going to work in your state and county? You can never be sure until you actually try and use them in a legal situation. I cannot tell you how many times that I have seen people prepare legal documents via some online legal document preparation firm and fail to dot an "i" or cross a "t". Most all of the mistakes that I see are in two main areas.

1) They fail to give the trustee the right powers; and

2) They fail to update their legal documents due to their death or disability of their trustees, successor trustees or beneficiaries.

Let me give you an example to ponder as to why you should always use an estate planning and an elder law attorney to draft and update your legal documents. This is an example of a lady who only had a will that she created online and never updated it.

In this example, an elderly man's unmarried adult daughter passes away with only a will that she created online. Her beneficiaries included her elderly father in addition to her two siblings. At the time the will was written, the elderly father was in good health. Fast forward a few years and the adult daughter gets ill with cancer and eventually succumbs to it and dies. While she was dying of cancer, her elderly father goes into a nursing home with dementia. The elderly father had a will leaving everything to his three children one of which just passed away. Now what?

Well, since the elderly father is now not legally competent and he doesn't have someone appointed by the court to handle his affairs, then someone has to go hire an attorney for him to obtain his share of his adult daughters estate which will have to go this route to get back to the two living siblings. Since the elderly father is in the nursing home with dementia, he is burning through all of his cash and runs out of all his cash. He didn't believe in Long Term Care Insurance. He sure could use the proceeds from his adult daughter's estate to help pay his nursing home costs, but unfortunately he has to have a legal guardian or conservator appointed first.

Meanwhile, while that is going on, the elderly father suddenly passes away. So, now the money from the adult daughter cannot be paid until her elderly father's estate goes through the probate process. The nursing home had to advise the family that they needed an attorney to get him qualified for Medicaid towards the end of his life. Nursing homes cost around $6,000 to $7,000 per month. If Medicaid pays it, then they want their money back when they can get it. In this case, Medicaid wanted their share of the proceeds of the adult daughter's estate! You see the elderly father ran out of funds while he was in the nursing home and had to go on Medicaid for about a year.

Now, the other siblings who thought they were the beneficiaries of their sister's and their elderly father's estates are going to get nothing from their father's estate. It is all going to pay back Medicaid and the probate attorney who had to step in and clean up this mess. Plus, they had to use some of the money that they inherited from their sister to pay for the attorney for their dad's guardianship, then later his estate and his burial, too. He didn't believe in life insurance either.

The moral of this story is that there are several things that could have happened to preserve family assets. The adult daughter could have hired an attorney to update her legal documents with a revocable living trust and keep them updated. In that document, it would have provided for contingencies. Anytime someone gets a serious illness, then those legal documents should be reviewed immediately. In addition, an elder law attorney could have saved most of the elderly father's estate with proper planning in advance. Further, the money from the sister's estate could have bypassed her elderly father's estate entirely once he went into the nursing home and gone directly to the two remaining siblings instead. However, one-third of their sister's estate which should have ended up with the two surviving siblings was gone like the wind to Medicaid.

Like I say in my book, estate planning and elder law attorneys are worth every single cent you pay them. The same cannot be said for doing your legal documents online and never updating them.

Do you realize that I may have just saved your family tens if not hundreds of thousands of dollars by telling you this? And, you thought that I was just another financial advisor.

Tuesday, September 2, 2014

Understanding the Anti-War Sentiment

It is probably not a good idea for any American or ally of America to send any journalist to the Middle East or Africa for the foreseeable future. Sadly, another American, Steven Sotloff was shown to be killed by ISIS in a Internet video. His mother begged that he be released, but they killed him anyway. Her quoting the Koran did no good. It is my belief that he was killed on the same day that James Foley was killed. They probably killed both men that day and just held back the video on Steven Sotloff until they wanted to release it. God bless both men and their families.

You simply cannot ignore this type of terrorism. I do believe that ISIS/Al Qaeda or the current Jihad name for the day will attack us in America at some point. They will probably try car bombs and suicide bombers at first. Later they may become more brazen and do more targeted mass killings with a group of terrorists where a large gathering of people are formed. I hope it never happens, but hope is not a defensive strategy.

President Obama knows that most Americans are tired of war and want nothing to do with it. He knows this and feels that he is complying with the American people's wishes. However, this ISIS problem is too big to be ignored. It doesn't matter whether we want war or not. We got it. Like it or not. Just because the American people don't want war, doesn't mean a thing. Your evidence is James Foley and Steven Sotloff.

I like to watch documentaries on wars and look at how decisions were made and why one side or the other won or lost. I have studied World War I, World War II, Vietnam, Irag and Afghanistan wars through documentaries. In every case, the side that lost or surrendered finally were put in a position where they had no choice but to give up. In other words, they lost their will to continue.

I am not a military person, but I know that if you don't have the will of Harry Truman during war, then you will likely fail. Think about the will of Harry Truman and his decision to bomb Hiroshima and Nagasaki. If he didn't have the will to do that, then the war in the Pacific would have continued to go on throughout the islands of the Pacific at great cost to both sides. President Truman made a conscious decision to kill innocent civilians in exchange for ending the war. Japan didn't surrender after the first bomb. It took two bombs for Japan to surrender.

The greatest generation as they are known, the soldiers of World War II, fought for our country and many died for our country. Some of those also fought in World War I. This generation of Americans understood war and got behind the war effort. They were American heroes who understood the danger of doing nothing. They sacrificed their lives for our country.

The baby boomers however are a different story. They grew up in the sixties with the war in Vietnam which was started by John F. Kennedy, a Democrat. The Vietnam war continued under Lyndon Johnson, also a Democrat and dragged on until it was finally ended by Richard Nixon, a Republican. During the sixties and seventies, there were numerous protests against the Vietnam war. These protests were all over the television and they helped to shape the anti-war sentiment of the baby boomers. Soldiers coming back from Vietnam were not hailed as heroes like the greatest generation were when they came back from World War II. These soldiers who fought and died in great numbers were treated horribly by a large group of these protesting American people. Vietnam veterans never received the respect and admiration that they deserved.

Fast forward to today and you must understand that we are losing more and more of the greatest generation every day. The baby boomers are a large demographic and they grew up with the Vietnam war. Is it really any surprise that fifty years later they are still adamantly against war of any type? Not to me.

If you talk to the military leaders of Vietnam, they will tell you that America was winning the Vietnam war and would have won it, if not for the demands of the American people and the lack of will. This same demographic of American people, the old protesters from the sixties and seventies are the ones today who do not want us to do anything other than limited action in Iraq, Syria and Africa. Just fire a few drones and be done with it, they think. They do not want us sending any troops over there at all. Unfortunately, this is the kind of thinking that got millions of Jewish people killed during World War II. No one had the stomach for war at first in World War II, but when we got attacked at Pearl Harbor everything changed. What bothers me is that James Foley and Steven Sotloff were brutally executed and no one seems to care. They don't care about the 150 or so Syrian solders who were stripped down to their underwear and shot and killed in the desert. They don't care about the 20 civilians in the Gaza strip killed by Hamas, because they were thought to have collaborated with the Israeli's. They don't care about the Yazidi's in Iraq who were murdered. They don't care about the many Christians who were murdered in Iraq and Africa. They simple do not care, because they foolishly believe that it doesn't affect them.

I wonder about those protesters from the sixties and seventies who seem to have so much influence over President Obama. I wonder will their attitudes change when there is no doubt that ISIS has come to American shores and carried out their terrorist activities? For America's sake, I sure hope so. In my opinion, it is better to kill them in Iraq and Syria than to kill them in New York City or Washington, D.C.

God bless America.

You simply cannot ignore this type of terrorism. I do believe that ISIS/Al Qaeda or the current Jihad name for the day will attack us in America at some point. They will probably try car bombs and suicide bombers at first. Later they may become more brazen and do more targeted mass killings with a group of terrorists where a large gathering of people are formed. I hope it never happens, but hope is not a defensive strategy.

President Obama knows that most Americans are tired of war and want nothing to do with it. He knows this and feels that he is complying with the American people's wishes. However, this ISIS problem is too big to be ignored. It doesn't matter whether we want war or not. We got it. Like it or not. Just because the American people don't want war, doesn't mean a thing. Your evidence is James Foley and Steven Sotloff.

I like to watch documentaries on wars and look at how decisions were made and why one side or the other won or lost. I have studied World War I, World War II, Vietnam, Irag and Afghanistan wars through documentaries. In every case, the side that lost or surrendered finally were put in a position where they had no choice but to give up. In other words, they lost their will to continue.

I am not a military person, but I know that if you don't have the will of Harry Truman during war, then you will likely fail. Think about the will of Harry Truman and his decision to bomb Hiroshima and Nagasaki. If he didn't have the will to do that, then the war in the Pacific would have continued to go on throughout the islands of the Pacific at great cost to both sides. President Truman made a conscious decision to kill innocent civilians in exchange for ending the war. Japan didn't surrender after the first bomb. It took two bombs for Japan to surrender.

The greatest generation as they are known, the soldiers of World War II, fought for our country and many died for our country. Some of those also fought in World War I. This generation of Americans understood war and got behind the war effort. They were American heroes who understood the danger of doing nothing. They sacrificed their lives for our country.

The baby boomers however are a different story. They grew up in the sixties with the war in Vietnam which was started by John F. Kennedy, a Democrat. The Vietnam war continued under Lyndon Johnson, also a Democrat and dragged on until it was finally ended by Richard Nixon, a Republican. During the sixties and seventies, there were numerous protests against the Vietnam war. These protests were all over the television and they helped to shape the anti-war sentiment of the baby boomers. Soldiers coming back from Vietnam were not hailed as heroes like the greatest generation were when they came back from World War II. These soldiers who fought and died in great numbers were treated horribly by a large group of these protesting American people. Vietnam veterans never received the respect and admiration that they deserved.

Fast forward to today and you must understand that we are losing more and more of the greatest generation every day. The baby boomers are a large demographic and they grew up with the Vietnam war. Is it really any surprise that fifty years later they are still adamantly against war of any type? Not to me.

If you talk to the military leaders of Vietnam, they will tell you that America was winning the Vietnam war and would have won it, if not for the demands of the American people and the lack of will. This same demographic of American people, the old protesters from the sixties and seventies are the ones today who do not want us to do anything other than limited action in Iraq, Syria and Africa. Just fire a few drones and be done with it, they think. They do not want us sending any troops over there at all. Unfortunately, this is the kind of thinking that got millions of Jewish people killed during World War II. No one had the stomach for war at first in World War II, but when we got attacked at Pearl Harbor everything changed. What bothers me is that James Foley and Steven Sotloff were brutally executed and no one seems to care. They don't care about the 150 or so Syrian solders who were stripped down to their underwear and shot and killed in the desert. They don't care about the 20 civilians in the Gaza strip killed by Hamas, because they were thought to have collaborated with the Israeli's. They don't care about the Yazidi's in Iraq who were murdered. They don't care about the many Christians who were murdered in Iraq and Africa. They simple do not care, because they foolishly believe that it doesn't affect them.

I wonder about those protesters from the sixties and seventies who seem to have so much influence over President Obama. I wonder will their attitudes change when there is no doubt that ISIS has come to American shores and carried out their terrorist activities? For America's sake, I sure hope so. In my opinion, it is better to kill them in Iraq and Syria than to kill them in New York City or Washington, D.C.

God bless America.

Friday, August 1, 2014

Finally! A Market Dip!

Finally, we are seeing a little bit of a pull back in the domestic stock market. This is very healthy for the overall market to continue to grow. We were at a point from a chart perspective that showed a top compared to past markets. Generally, the market tends to turn south after it hits this area and that is precisely what has finally happened. Thank goodness, because this brings stock valuations down to more attractive levels, then in turn this further attracts investments.

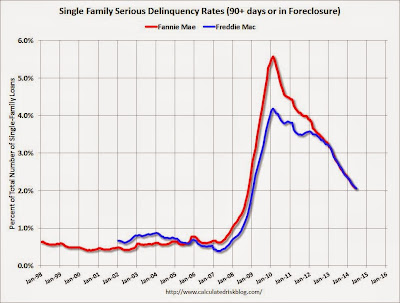

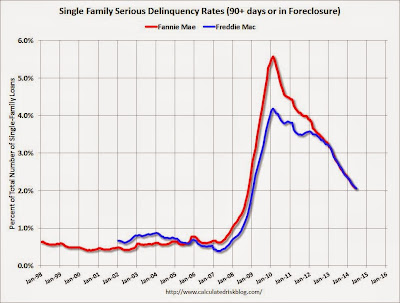

Nothing to worry about as far as the stock market is concerned in an election year. Typically, election year stock market returns do well. In fact, we are on a pace for the best year since 1999 for both total and private job growth.You can see by this chart from www.CalculatedRiskBlog.com that we have come a long way back up since the recent bottom.

State and local governments have turned the corner as it relates to jobs, too. They had declined for four years in a row, but have recently turned the corner and our climbing once again.

Housing continues to rebound. Serious delinquencies continue to decline at a fast clip. We should be back at the historical serious delinquency rate of under 1% in 2015 or early 2016 according to Calculated Risk. We are not there year, but we are rapidly approaching that 1% level. This kind of proves the cold hard facts that it takes 7 to 10 years to fully recover from a market bubble. It started in 2007 and by the time we get to 2016, it will have been 9 years to recovery.

We might have a flat quarter, or even down a little bit, but as we get closer to the election we should see people getting excited about their side winning. This typically helps the market go up. The point is that it is important to stay invested. It is not smart to get out of the market right now. The underlying economy is doing well. Stay the course.

Thanks to Calculated Risk Blog.

Nothing to worry about as far as the stock market is concerned in an election year. Typically, election year stock market returns do well. In fact, we are on a pace for the best year since 1999 for both total and private job growth.You can see by this chart from www.CalculatedRiskBlog.com that we have come a long way back up since the recent bottom.

State and local governments have turned the corner as it relates to jobs, too. They had declined for four years in a row, but have recently turned the corner and our climbing once again.

Housing continues to rebound. Serious delinquencies continue to decline at a fast clip. We should be back at the historical serious delinquency rate of under 1% in 2015 or early 2016 according to Calculated Risk. We are not there year, but we are rapidly approaching that 1% level. This kind of proves the cold hard facts that it takes 7 to 10 years to fully recover from a market bubble. It started in 2007 and by the time we get to 2016, it will have been 9 years to recovery.

We might have a flat quarter, or even down a little bit, but as we get closer to the election we should see people getting excited about their side winning. This typically helps the market go up. The point is that it is important to stay invested. It is not smart to get out of the market right now. The underlying economy is doing well. Stay the course.

Thanks to Calculated Risk Blog.

Thursday, July 24, 2014

Genealogy Discoveries

In my spare time, I have been on a genealogical expedition in a quest for finding the first Allison male to come to America. I was born Richard Mark Allison and my name changed when I was 14 to Richard Allison Johnson. My biological father, Billy Joe Allison died when I was a senior in high school and there has always been this black hole in my life as a result. I have always wanted to know more about my Allison family, so I decided to begin an expedition to find out.

There are several sources on the Internet where you can get information, but most of them charge you money every month. Personally, I am not a big fan of paying for information when I might be able to find it for free. There are some free sites that I used to gather the information. One of them is www.familysearch.org and another is www.rootsweb.com which is the free side of www.ancestry.com. Yet another free site that was very helpful is www.findagrave.com.

With all of these sites, you have to keep in mind that some of these records can be a little inaccurate with misspellings of names. In addition, back in the days of when the census people came around and beat on the door, then took down what you told them and wrote it on a piece of paper. A lot of times, the people being questioned didn't want to give the government their full names, so they would just say R.M. Allison, instead of Richard Mark Allison, for example.

Also, on the Find a Grave site, there are these wonderful people who go through cemeteries and take pictures of the graves. Sometimes, they are family descendants and sometimes they are not. They may not know that another relative who died might be in a different cemetery and the link is missing from Find a Grave. I know in my own search, a lot of times the parents would be listed with some of their children, but not all of them. This could be because they are still alive, or it could be that the person who put the information on Find a Grave didn't know that there was more children.

Anyway, I was able to find the first Allison male to come to America who was born in 1675 in Londonderry, Northern Ireland. After that, I was able to trace the family tree all the way down to me. It was an arduous task, but it has been well worth the effort. That black hole that I had is filled in a little bit now.

I discussed doing genealogical research in my book, Meet Wally Street. The Reason You're Stupid as being a good thing to do if you are retired and bored to tears. If you need any pointers or tips, then don't hesitate to ask me.

There are several sources on the Internet where you can get information, but most of them charge you money every month. Personally, I am not a big fan of paying for information when I might be able to find it for free. There are some free sites that I used to gather the information. One of them is www.familysearch.org and another is www.rootsweb.com which is the free side of www.ancestry.com. Yet another free site that was very helpful is www.findagrave.com.

With all of these sites, you have to keep in mind that some of these records can be a little inaccurate with misspellings of names. In addition, back in the days of when the census people came around and beat on the door, then took down what you told them and wrote it on a piece of paper. A lot of times, the people being questioned didn't want to give the government their full names, so they would just say R.M. Allison, instead of Richard Mark Allison, for example.

Also, on the Find a Grave site, there are these wonderful people who go through cemeteries and take pictures of the graves. Sometimes, they are family descendants and sometimes they are not. They may not know that another relative who died might be in a different cemetery and the link is missing from Find a Grave. I know in my own search, a lot of times the parents would be listed with some of their children, but not all of them. This could be because they are still alive, or it could be that the person who put the information on Find a Grave didn't know that there was more children.

Anyway, I was able to find the first Allison male to come to America who was born in 1675 in Londonderry, Northern Ireland. After that, I was able to trace the family tree all the way down to me. It was an arduous task, but it has been well worth the effort. That black hole that I had is filled in a little bit now.