Nothing to worry about as far as the stock market is concerned in an election year. Typically, election year stock market returns do well. In fact, we are on a pace for the best year since 1999 for both total and private job growth.You can see by this chart from www.CalculatedRiskBlog.com that we have come a long way back up since the recent bottom.

State and local governments have turned the corner as it relates to jobs, too. They had declined for four years in a row, but have recently turned the corner and our climbing once again.

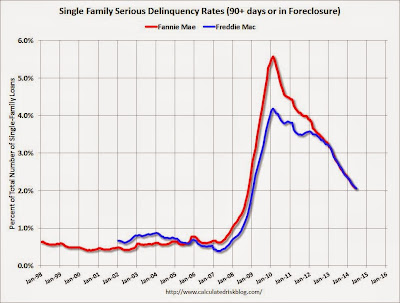

Housing continues to rebound. Serious delinquencies continue to decline at a fast clip. We should be back at the historical serious delinquency rate of under 1% in 2015 or early 2016 according to Calculated Risk. We are not there year, but we are rapidly approaching that 1% level. This kind of proves the cold hard facts that it takes 7 to 10 years to fully recover from a market bubble. It started in 2007 and by the time we get to 2016, it will have been 9 years to recovery.

We might have a flat quarter, or even down a little bit, but as we get closer to the election we should see people getting excited about their side winning. This typically helps the market go up. The point is that it is important to stay invested. It is not smart to get out of the market right now. The underlying economy is doing well. Stay the course.

Thanks to Calculated Risk Blog.