I recently heard about something very scary in relation to an 80 year old man living alone. A couple knocked on the door saying they were friends of a neighbor and wanted to come in and see his antiques. Once inside they scoured the home for valuables. They questioned the man about what was going to happen to his antiques and other possessions once he died, which is totally inappropriate. They kept asking probing questions about how much the antiques were worth, where do the family members live and who is he leaving these to in his will. After he finally got them to leave, he called the neighbor and asked if she knew them and she said she wasn't sure, but their name seemed familiar.

The next day, the man received a call from someone claiming to be his granddaughter who wanted money of course. The man realized it was a scam and hung up, since he didn't have any granddaughters.

There are several things to be aware of here. One is that those people could have knocked this elderly man in the head and taken whatever they wanted, or worse killed him. He should have never let them inside since he didn't know them.

Second, they could be setting him up for a break-in later, now that they know the layout of the home. They could be watching his house looking for him to leave and swoop in and steal whatever they wanted.

Further, these scammers could easily find out who lives in the neighborhood and pick out an equally elderly neighbor that they might rely on for a faint memory. They simply act as if they know the neighbor when in fact they just "googled" the neighbor and got their name figuring the elderly man would know the close neighbor. In reality, the neighbor doesn't know them at all.

Finally, they could be in cahoots with the supposed granddaughter who called the next day. The fact that this call was the very next day after this couple's visit was pretty suspicious.

It is hard to believe that there are people like this who prey on the elderly, but sadly there are way too many of them. If you have elderly family of friends, then make sure you check on them often and report any suspicious activity to the police.

This Blog is the Opinion of Rick Allison, the Author of: Designing an Investment Portfolio for American Patriots. Rick's Registered Investment Adviser web site is located at: www.marianfs.com.

Wednesday, December 10, 2014

Monday, December 8, 2014

Just Like I Wrote It

The other day, I went into one of the major banks where I had opened an estate account for a client who passed away. We took care of everything for the client and their beneficiaries and I needed to close the account. I had originally considered opening this account with Schwab, but their review process would have taken three weeks and we needed to close on some real estate sooner than that, so I was forced to go to one of the major banks.

Just so happens, we have some personal accounts at this bank and when I sat down to close the account, the lady tried to sell me everything under the sun. This major bank doesn't do personal loans any more, but they will gladly give you a credit card. She tried to get me to open a credit card account.

I said "No thanks."

Then she tried to get me to take cash out of one of my credit card accounts.

"Why the hell do I want to run up my credit card bill?", I thought to myself.

I said "No thanks."

Then, she tried to get me to refinance my home equity loan for about 1.5% higher than my current rate.

Again, I said "No thanks."

Then, she tried to get me to refinance my home loan which was about 1% higher than my current rate.

"No!", I said.

She finally gave up and closed the account after wasting about 10 minutes of my time. She could tell I was getting perturbed.

This is the typical experience at a major bank today. I hate the damn bank and everything it represents. I would not even have the credit card at this bank if it wasn't for the bank buying my former credit card company. I never even opened the credit card with this bank. They just forced me into their devilish den. I may have to move that credit card account now after that fiasco.

While she was giving me this sales pitch, I couldn't help but notice an older man in the back office with a young stockbroker from a major brokerage firm that just so happens to be owned by the bank. Imagine that. This poor man was around 70 years old and he was doing business in the absolute worst place possible.

Hadn't he read my book? Of course he hasn't. Otherwise, he would have never set foot in that guy's office.

Doesn't he know that these stockbroker's are in business to generate the most revenue possible from him?

Why on earth would you ever do business with a bank owned brokerage firm?

It is so asinine. I am sure that if I reviewed this guy's investment statements, I would see variable annuities, loaded mutual funds, non-publicly traded REIT's and UIT's. Why? Because these are the products that make the bank the most money!

If you do your investment business with a bank or a bank owned brokerage firm, then STOP IT!!! They are ripping you off. For proof, all you have to do is look at your own statements. If you own variable annuities, loaded mutual funds, non-publicly traded REIT's and UIT's, then congratulations you been had. I'm sorry to be so blunt, but you need to wise up and quit letting these people rip you off.

When I went into this bank to close it out, I knew what to expect. I knew they would try and sell me everything under the sun. The poor old man was getting his head taken off in commissions and lack of liquidity and for what? I will tell you for what. The profits of the bank. They don't give a flying you know what about their clients. I don't care what line of BS you hear or what frilly commercials you see on television. They are in business to make as much money as they can off of you. Don't you ever forget it.

The only place to do your investment business is with an Independent Registered Investment Adviser who is not affiliated with a bank, brokerage firm or insurance company.

Of course, when little unknown guys like me write books, it is so hard to get any traction on book sales unless you are somebody famous. In my opinion, if a book does something to help you, then it doesn't make a hill of beans who wrote it. What may surprise people to know is that my book, "Meet Wally Street. The Reason You're Stupid." would have warned the 70 year old gentlemen never to do business with a bank owned brokerage firm period. In other words, it would have helped him!

I described this exact scenario to watch out for in my book. This is how it always is with me. I will write about something and read about other people's horror stories describing it later. Except in this case, I saw it with my own two eyes. It was sad to see let me tell you. I feel sorry for that elderly gentleman.

If you want a Christmas gift idea, then give people my book. You will save them a lot of money and headaches. It is only $3.99 on electronic devices and only $19.99 if you are old fashioned and want a real book. That's a bargain compared to the money that you will save them.

Merry Christmas to you and yours.

Just so happens, we have some personal accounts at this bank and when I sat down to close the account, the lady tried to sell me everything under the sun. This major bank doesn't do personal loans any more, but they will gladly give you a credit card. She tried to get me to open a credit card account.

I said "No thanks."

Then she tried to get me to take cash out of one of my credit card accounts.

"Why the hell do I want to run up my credit card bill?", I thought to myself.

I said "No thanks."

Then, she tried to get me to refinance my home equity loan for about 1.5% higher than my current rate.

Again, I said "No thanks."

Then, she tried to get me to refinance my home loan which was about 1% higher than my current rate.

"No!", I said.

She finally gave up and closed the account after wasting about 10 minutes of my time. She could tell I was getting perturbed.

This is the typical experience at a major bank today. I hate the damn bank and everything it represents. I would not even have the credit card at this bank if it wasn't for the bank buying my former credit card company. I never even opened the credit card with this bank. They just forced me into their devilish den. I may have to move that credit card account now after that fiasco.

While she was giving me this sales pitch, I couldn't help but notice an older man in the back office with a young stockbroker from a major brokerage firm that just so happens to be owned by the bank. Imagine that. This poor man was around 70 years old and he was doing business in the absolute worst place possible.

Hadn't he read my book? Of course he hasn't. Otherwise, he would have never set foot in that guy's office.

Doesn't he know that these stockbroker's are in business to generate the most revenue possible from him?

Why on earth would you ever do business with a bank owned brokerage firm?

It is so asinine. I am sure that if I reviewed this guy's investment statements, I would see variable annuities, loaded mutual funds, non-publicly traded REIT's and UIT's. Why? Because these are the products that make the bank the most money!

If you do your investment business with a bank or a bank owned brokerage firm, then STOP IT!!! They are ripping you off. For proof, all you have to do is look at your own statements. If you own variable annuities, loaded mutual funds, non-publicly traded REIT's and UIT's, then congratulations you been had. I'm sorry to be so blunt, but you need to wise up and quit letting these people rip you off.

When I went into this bank to close it out, I knew what to expect. I knew they would try and sell me everything under the sun. The poor old man was getting his head taken off in commissions and lack of liquidity and for what? I will tell you for what. The profits of the bank. They don't give a flying you know what about their clients. I don't care what line of BS you hear or what frilly commercials you see on television. They are in business to make as much money as they can off of you. Don't you ever forget it.

The only place to do your investment business is with an Independent Registered Investment Adviser who is not affiliated with a bank, brokerage firm or insurance company.

Of course, when little unknown guys like me write books, it is so hard to get any traction on book sales unless you are somebody famous. In my opinion, if a book does something to help you, then it doesn't make a hill of beans who wrote it. What may surprise people to know is that my book, "Meet Wally Street. The Reason You're Stupid." would have warned the 70 year old gentlemen never to do business with a bank owned brokerage firm period. In other words, it would have helped him!

I described this exact scenario to watch out for in my book. This is how it always is with me. I will write about something and read about other people's horror stories describing it later. Except in this case, I saw it with my own two eyes. It was sad to see let me tell you. I feel sorry for that elderly gentleman.

If you want a Christmas gift idea, then give people my book. You will save them a lot of money and headaches. It is only $3.99 on electronic devices and only $19.99 if you are old fashioned and want a real book. That's a bargain compared to the money that you will save them.

Merry Christmas to you and yours.

Tuesday, September 30, 2014

What's Your Viewpoint?

The other day, I was thinking about something that has never happened to me personally. I have never been fired from a job in my life. Going all the way back to my first job slopping food at the local hospital through today. What struck me about it was the fact that I have no idea what it is like to be fired. I have been on the other side of the table however. I have been the one doing the firing. In fact, over my lifetime, I have fired several people. Of course, I am sure that I was the villain in each of the firings from the point of view of the person being fired. However, they would be wrong, because I never fired anyone who did not deserve to be fired. Most of the time, it boiled down to two or three issues.

For what it is worth, I wanted to give some advice on this subject of being fired or laid off. If you believe in God, then you have heard the quote from the Bible that "God has a plan for you". Forgive me for paraphrasing. The burning question is do you believe this? I mean do you really believe this?

If you were fired or laid off and if you immediately get mad, blame others, refuse to accept any responsibility for it, then you do not believe that God has a plan for you. It is a question of faith. You lack faith. There is no disputing it either.

On the other hand, if you look at it as part of God's plan for you, then you will realize that there are other things that you are meant to do. If so, then why spend another day at that old job? If your faith lends you to believe in God's plan for you, then you will never get mad, blame others, nor refuse to accept responsibility for your actions. Instead, you will rejoice at the new opportunity in front of you.

There are really just two ways to handle being fired or laid off. Dwell in the house of despair and dysfunction or look forward to great things.

- They failed to show up for work regularly;

- They failed to come anywhere near their performance metrics; or

- They were stealing something from the company.

For what it is worth, I wanted to give some advice on this subject of being fired or laid off. If you believe in God, then you have heard the quote from the Bible that "God has a plan for you". Forgive me for paraphrasing. The burning question is do you believe this? I mean do you really believe this?

If you were fired or laid off and if you immediately get mad, blame others, refuse to accept any responsibility for it, then you do not believe that God has a plan for you. It is a question of faith. You lack faith. There is no disputing it either.

On the other hand, if you look at it as part of God's plan for you, then you will realize that there are other things that you are meant to do. If so, then why spend another day at that old job? If your faith lends you to believe in God's plan for you, then you will never get mad, blame others, nor refuse to accept responsibility for your actions. Instead, you will rejoice at the new opportunity in front of you.

There are really just two ways to handle being fired or laid off. Dwell in the house of despair and dysfunction or look forward to great things.

Wednesday, September 24, 2014

Legal Zoom Effect

Did Legal Zoom replace estate planning attorneys? Not hardly, but they did make life difficult for them. I can remember about 10 years ago when attorneys were getting as much as $5,000 for a revocable living trust with all the ancillary documents. Today, I think most attorneys will charge somewhere in the $1,000 to $2,000 range for the same services. A lot of attorneys will not waste their time for anything less than $1,000. It is simply not worth it to them. Legal Zoom had a fee compression effect on attorneys' fees.

I have a story in my book, Meet Wally Street, The Reason You're Stupid about people who use online legal document preparation firms. What most people do not think about when they use these online legal document preparation firms is that all they are doing is part of the equation. Yes, they are creating the documents at a discounted price from most attorneys, but they are failing to consider a lot of factors in their decision. One of those being...

How do you know the documents that you created online are going to work in your state and county? You can never be sure until you actually try and use them in a legal situation. I cannot tell you how many times that I have seen people prepare legal documents via some online legal document preparation firm and fail to dot an "i" or cross a "t". Most all of the mistakes that I see are in two main areas.

1) They fail to give the trustee the right powers; and

2) They fail to update their legal documents due to their death or disability of their trustees, successor trustees or beneficiaries.

Let me give you an example to ponder as to why you should always use an estate planning and an elder law attorney to draft and update your legal documents. This is an example of a lady who only had a will that she created online and never updated it.

In this example, an elderly man's unmarried adult daughter passes away with only a will that she created online. Her beneficiaries included her elderly father in addition to her two siblings. At the time the will was written, the elderly father was in good health. Fast forward a few years and the adult daughter gets ill with cancer and eventually succumbs to it and dies. While she was dying of cancer, her elderly father goes into a nursing home with dementia. The elderly father had a will leaving everything to his three children one of which just passed away. Now what?

Well, since the elderly father is now not legally competent and he doesn't have someone appointed by the court to handle his affairs, then someone has to go hire an attorney for him to obtain his share of his adult daughters estate which will have to go this route to get back to the two living siblings. Since the elderly father is in the nursing home with dementia, he is burning through all of his cash and runs out of all his cash. He didn't believe in Long Term Care Insurance. He sure could use the proceeds from his adult daughter's estate to help pay his nursing home costs, but unfortunately he has to have a legal guardian or conservator appointed first.

Meanwhile, while that is going on, the elderly father suddenly passes away. So, now the money from the adult daughter cannot be paid until her elderly father's estate goes through the probate process. The nursing home had to advise the family that they needed an attorney to get him qualified for Medicaid towards the end of his life. Nursing homes cost around $6,000 to $7,000 per month. If Medicaid pays it, then they want their money back when they can get it. In this case, Medicaid wanted their share of the proceeds of the adult daughter's estate! You see the elderly father ran out of funds while he was in the nursing home and had to go on Medicaid for about a year.

Now, the other siblings who thought they were the beneficiaries of their sister's and their elderly father's estates are going to get nothing from their father's estate. It is all going to pay back Medicaid and the probate attorney who had to step in and clean up this mess. Plus, they had to use some of the money that they inherited from their sister to pay for the attorney for their dad's guardianship, then later his estate and his burial, too. He didn't believe in life insurance either.

The moral of this story is that there are several things that could have happened to preserve family assets. The adult daughter could have hired an attorney to update her legal documents with a revocable living trust and keep them updated. In that document, it would have provided for contingencies. Anytime someone gets a serious illness, then those legal documents should be reviewed immediately. In addition, an elder law attorney could have saved most of the elderly father's estate with proper planning in advance. Further, the money from the sister's estate could have bypassed her elderly father's estate entirely once he went into the nursing home and gone directly to the two remaining siblings instead. However, one-third of their sister's estate which should have ended up with the two surviving siblings was gone like the wind to Medicaid.

Like I say in my book, estate planning and elder law attorneys are worth every single cent you pay them. The same cannot be said for doing your legal documents online and never updating them.

Do you realize that I may have just saved your family tens if not hundreds of thousands of dollars by telling you this? And, you thought that I was just another financial advisor.

I have a story in my book, Meet Wally Street, The Reason You're Stupid about people who use online legal document preparation firms. What most people do not think about when they use these online legal document preparation firms is that all they are doing is part of the equation. Yes, they are creating the documents at a discounted price from most attorneys, but they are failing to consider a lot of factors in their decision. One of those being...

Is this going to work?

How do you know the documents that you created online are going to work in your state and county? You can never be sure until you actually try and use them in a legal situation. I cannot tell you how many times that I have seen people prepare legal documents via some online legal document preparation firm and fail to dot an "i" or cross a "t". Most all of the mistakes that I see are in two main areas.

1) They fail to give the trustee the right powers; and

2) They fail to update their legal documents due to their death or disability of their trustees, successor trustees or beneficiaries.

Let me give you an example to ponder as to why you should always use an estate planning and an elder law attorney to draft and update your legal documents. This is an example of a lady who only had a will that she created online and never updated it.

In this example, an elderly man's unmarried adult daughter passes away with only a will that she created online. Her beneficiaries included her elderly father in addition to her two siblings. At the time the will was written, the elderly father was in good health. Fast forward a few years and the adult daughter gets ill with cancer and eventually succumbs to it and dies. While she was dying of cancer, her elderly father goes into a nursing home with dementia. The elderly father had a will leaving everything to his three children one of which just passed away. Now what?

Well, since the elderly father is now not legally competent and he doesn't have someone appointed by the court to handle his affairs, then someone has to go hire an attorney for him to obtain his share of his adult daughters estate which will have to go this route to get back to the two living siblings. Since the elderly father is in the nursing home with dementia, he is burning through all of his cash and runs out of all his cash. He didn't believe in Long Term Care Insurance. He sure could use the proceeds from his adult daughter's estate to help pay his nursing home costs, but unfortunately he has to have a legal guardian or conservator appointed first.

Meanwhile, while that is going on, the elderly father suddenly passes away. So, now the money from the adult daughter cannot be paid until her elderly father's estate goes through the probate process. The nursing home had to advise the family that they needed an attorney to get him qualified for Medicaid towards the end of his life. Nursing homes cost around $6,000 to $7,000 per month. If Medicaid pays it, then they want their money back when they can get it. In this case, Medicaid wanted their share of the proceeds of the adult daughter's estate! You see the elderly father ran out of funds while he was in the nursing home and had to go on Medicaid for about a year.

Now, the other siblings who thought they were the beneficiaries of their sister's and their elderly father's estates are going to get nothing from their father's estate. It is all going to pay back Medicaid and the probate attorney who had to step in and clean up this mess. Plus, they had to use some of the money that they inherited from their sister to pay for the attorney for their dad's guardianship, then later his estate and his burial, too. He didn't believe in life insurance either.

The moral of this story is that there are several things that could have happened to preserve family assets. The adult daughter could have hired an attorney to update her legal documents with a revocable living trust and keep them updated. In that document, it would have provided for contingencies. Anytime someone gets a serious illness, then those legal documents should be reviewed immediately. In addition, an elder law attorney could have saved most of the elderly father's estate with proper planning in advance. Further, the money from the sister's estate could have bypassed her elderly father's estate entirely once he went into the nursing home and gone directly to the two remaining siblings instead. However, one-third of their sister's estate which should have ended up with the two surviving siblings was gone like the wind to Medicaid.

Like I say in my book, estate planning and elder law attorneys are worth every single cent you pay them. The same cannot be said for doing your legal documents online and never updating them.

Do you realize that I may have just saved your family tens if not hundreds of thousands of dollars by telling you this? And, you thought that I was just another financial advisor.

Tuesday, September 2, 2014

Understanding the Anti-War Sentiment

It is probably not a good idea for any American or ally of America to send any journalist to the Middle East or Africa for the foreseeable future. Sadly, another American, Steven Sotloff was shown to be killed by ISIS in a Internet video. His mother begged that he be released, but they killed him anyway. Her quoting the Koran did no good. It is my belief that he was killed on the same day that James Foley was killed. They probably killed both men that day and just held back the video on Steven Sotloff until they wanted to release it. God bless both men and their families.

You simply cannot ignore this type of terrorism. I do believe that ISIS/Al Qaeda or the current Jihad name for the day will attack us in America at some point. They will probably try car bombs and suicide bombers at first. Later they may become more brazen and do more targeted mass killings with a group of terrorists where a large gathering of people are formed. I hope it never happens, but hope is not a defensive strategy.

President Obama knows that most Americans are tired of war and want nothing to do with it. He knows this and feels that he is complying with the American people's wishes. However, this ISIS problem is too big to be ignored. It doesn't matter whether we want war or not. We got it. Like it or not. Just because the American people don't want war, doesn't mean a thing. Your evidence is James Foley and Steven Sotloff.

I like to watch documentaries on wars and look at how decisions were made and why one side or the other won or lost. I have studied World War I, World War II, Vietnam, Irag and Afghanistan wars through documentaries. In every case, the side that lost or surrendered finally were put in a position where they had no choice but to give up. In other words, they lost their will to continue.

I am not a military person, but I know that if you don't have the will of Harry Truman during war, then you will likely fail. Think about the will of Harry Truman and his decision to bomb Hiroshima and Nagasaki. If he didn't have the will to do that, then the war in the Pacific would have continued to go on throughout the islands of the Pacific at great cost to both sides. President Truman made a conscious decision to kill innocent civilians in exchange for ending the war. Japan didn't surrender after the first bomb. It took two bombs for Japan to surrender.

The greatest generation as they are known, the soldiers of World War II, fought for our country and many died for our country. Some of those also fought in World War I. This generation of Americans understood war and got behind the war effort. They were American heroes who understood the danger of doing nothing. They sacrificed their lives for our country.

The baby boomers however are a different story. They grew up in the sixties with the war in Vietnam which was started by John F. Kennedy, a Democrat. The Vietnam war continued under Lyndon Johnson, also a Democrat and dragged on until it was finally ended by Richard Nixon, a Republican. During the sixties and seventies, there were numerous protests against the Vietnam war. These protests were all over the television and they helped to shape the anti-war sentiment of the baby boomers. Soldiers coming back from Vietnam were not hailed as heroes like the greatest generation were when they came back from World War II. These soldiers who fought and died in great numbers were treated horribly by a large group of these protesting American people. Vietnam veterans never received the respect and admiration that they deserved.

Fast forward to today and you must understand that we are losing more and more of the greatest generation every day. The baby boomers are a large demographic and they grew up with the Vietnam war. Is it really any surprise that fifty years later they are still adamantly against war of any type? Not to me.

If you talk to the military leaders of Vietnam, they will tell you that America was winning the Vietnam war and would have won it, if not for the demands of the American people and the lack of will. This same demographic of American people, the old protesters from the sixties and seventies are the ones today who do not want us to do anything other than limited action in Iraq, Syria and Africa. Just fire a few drones and be done with it, they think. They do not want us sending any troops over there at all. Unfortunately, this is the kind of thinking that got millions of Jewish people killed during World War II. No one had the stomach for war at first in World War II, but when we got attacked at Pearl Harbor everything changed. What bothers me is that James Foley and Steven Sotloff were brutally executed and no one seems to care. They don't care about the 150 or so Syrian solders who were stripped down to their underwear and shot and killed in the desert. They don't care about the 20 civilians in the Gaza strip killed by Hamas, because they were thought to have collaborated with the Israeli's. They don't care about the Yazidi's in Iraq who were murdered. They don't care about the many Christians who were murdered in Iraq and Africa. They simple do not care, because they foolishly believe that it doesn't affect them.

I wonder about those protesters from the sixties and seventies who seem to have so much influence over President Obama. I wonder will their attitudes change when there is no doubt that ISIS has come to American shores and carried out their terrorist activities? For America's sake, I sure hope so. In my opinion, it is better to kill them in Iraq and Syria than to kill them in New York City or Washington, D.C.

God bless America.

You simply cannot ignore this type of terrorism. I do believe that ISIS/Al Qaeda or the current Jihad name for the day will attack us in America at some point. They will probably try car bombs and suicide bombers at first. Later they may become more brazen and do more targeted mass killings with a group of terrorists where a large gathering of people are formed. I hope it never happens, but hope is not a defensive strategy.

President Obama knows that most Americans are tired of war and want nothing to do with it. He knows this and feels that he is complying with the American people's wishes. However, this ISIS problem is too big to be ignored. It doesn't matter whether we want war or not. We got it. Like it or not. Just because the American people don't want war, doesn't mean a thing. Your evidence is James Foley and Steven Sotloff.

I like to watch documentaries on wars and look at how decisions were made and why one side or the other won or lost. I have studied World War I, World War II, Vietnam, Irag and Afghanistan wars through documentaries. In every case, the side that lost or surrendered finally were put in a position where they had no choice but to give up. In other words, they lost their will to continue.

I am not a military person, but I know that if you don't have the will of Harry Truman during war, then you will likely fail. Think about the will of Harry Truman and his decision to bomb Hiroshima and Nagasaki. If he didn't have the will to do that, then the war in the Pacific would have continued to go on throughout the islands of the Pacific at great cost to both sides. President Truman made a conscious decision to kill innocent civilians in exchange for ending the war. Japan didn't surrender after the first bomb. It took two bombs for Japan to surrender.

The greatest generation as they are known, the soldiers of World War II, fought for our country and many died for our country. Some of those also fought in World War I. This generation of Americans understood war and got behind the war effort. They were American heroes who understood the danger of doing nothing. They sacrificed their lives for our country.

The baby boomers however are a different story. They grew up in the sixties with the war in Vietnam which was started by John F. Kennedy, a Democrat. The Vietnam war continued under Lyndon Johnson, also a Democrat and dragged on until it was finally ended by Richard Nixon, a Republican. During the sixties and seventies, there were numerous protests against the Vietnam war. These protests were all over the television and they helped to shape the anti-war sentiment of the baby boomers. Soldiers coming back from Vietnam were not hailed as heroes like the greatest generation were when they came back from World War II. These soldiers who fought and died in great numbers were treated horribly by a large group of these protesting American people. Vietnam veterans never received the respect and admiration that they deserved.

Fast forward to today and you must understand that we are losing more and more of the greatest generation every day. The baby boomers are a large demographic and they grew up with the Vietnam war. Is it really any surprise that fifty years later they are still adamantly against war of any type? Not to me.

If you talk to the military leaders of Vietnam, they will tell you that America was winning the Vietnam war and would have won it, if not for the demands of the American people and the lack of will. This same demographic of American people, the old protesters from the sixties and seventies are the ones today who do not want us to do anything other than limited action in Iraq, Syria and Africa. Just fire a few drones and be done with it, they think. They do not want us sending any troops over there at all. Unfortunately, this is the kind of thinking that got millions of Jewish people killed during World War II. No one had the stomach for war at first in World War II, but when we got attacked at Pearl Harbor everything changed. What bothers me is that James Foley and Steven Sotloff were brutally executed and no one seems to care. They don't care about the 150 or so Syrian solders who were stripped down to their underwear and shot and killed in the desert. They don't care about the 20 civilians in the Gaza strip killed by Hamas, because they were thought to have collaborated with the Israeli's. They don't care about the Yazidi's in Iraq who were murdered. They don't care about the many Christians who were murdered in Iraq and Africa. They simple do not care, because they foolishly believe that it doesn't affect them.

I wonder about those protesters from the sixties and seventies who seem to have so much influence over President Obama. I wonder will their attitudes change when there is no doubt that ISIS has come to American shores and carried out their terrorist activities? For America's sake, I sure hope so. In my opinion, it is better to kill them in Iraq and Syria than to kill them in New York City or Washington, D.C.

God bless America.

Friday, August 1, 2014

Finally! A Market Dip!

Finally, we are seeing a little bit of a pull back in the domestic stock market. This is very healthy for the overall market to continue to grow. We were at a point from a chart perspective that showed a top compared to past markets. Generally, the market tends to turn south after it hits this area and that is precisely what has finally happened. Thank goodness, because this brings stock valuations down to more attractive levels, then in turn this further attracts investments.

Nothing to worry about as far as the stock market is concerned in an election year. Typically, election year stock market returns do well. In fact, we are on a pace for the best year since 1999 for both total and private job growth.You can see by this chart from www.CalculatedRiskBlog.com that we have come a long way back up since the recent bottom.

State and local governments have turned the corner as it relates to jobs, too. They had declined for four years in a row, but have recently turned the corner and our climbing once again.

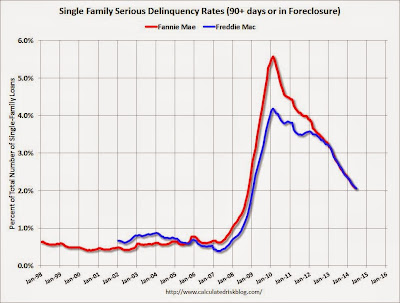

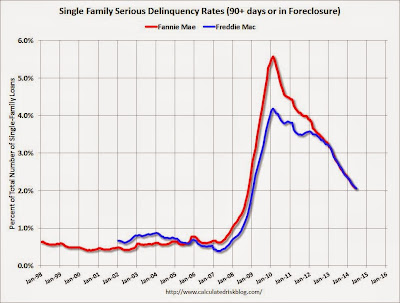

Housing continues to rebound. Serious delinquencies continue to decline at a fast clip. We should be back at the historical serious delinquency rate of under 1% in 2015 or early 2016 according to Calculated Risk. We are not there year, but we are rapidly approaching that 1% level. This kind of proves the cold hard facts that it takes 7 to 10 years to fully recover from a market bubble. It started in 2007 and by the time we get to 2016, it will have been 9 years to recovery.

We might have a flat quarter, or even down a little bit, but as we get closer to the election we should see people getting excited about their side winning. This typically helps the market go up. The point is that it is important to stay invested. It is not smart to get out of the market right now. The underlying economy is doing well. Stay the course.

Thanks to Calculated Risk Blog.

Nothing to worry about as far as the stock market is concerned in an election year. Typically, election year stock market returns do well. In fact, we are on a pace for the best year since 1999 for both total and private job growth.You can see by this chart from www.CalculatedRiskBlog.com that we have come a long way back up since the recent bottom.

State and local governments have turned the corner as it relates to jobs, too. They had declined for four years in a row, but have recently turned the corner and our climbing once again.

Housing continues to rebound. Serious delinquencies continue to decline at a fast clip. We should be back at the historical serious delinquency rate of under 1% in 2015 or early 2016 according to Calculated Risk. We are not there year, but we are rapidly approaching that 1% level. This kind of proves the cold hard facts that it takes 7 to 10 years to fully recover from a market bubble. It started in 2007 and by the time we get to 2016, it will have been 9 years to recovery.

We might have a flat quarter, or even down a little bit, but as we get closer to the election we should see people getting excited about their side winning. This typically helps the market go up. The point is that it is important to stay invested. It is not smart to get out of the market right now. The underlying economy is doing well. Stay the course.

Thanks to Calculated Risk Blog.

Thursday, July 24, 2014

Genealogy Discoveries

In my spare time, I have been on a genealogical expedition in a quest for finding the first Allison male to come to America. I was born Richard Mark Allison and my name changed when I was 14 to Richard Allison Johnson. My biological father, Billy Joe Allison died when I was a senior in high school and there has always been this black hole in my life as a result. I have always wanted to know more about my Allison family, so I decided to begin an expedition to find out.

There are several sources on the Internet where you can get information, but most of them charge you money every month. Personally, I am not a big fan of paying for information when I might be able to find it for free. There are some free sites that I used to gather the information. One of them is www.familysearch.org and another is www.rootsweb.com which is the free side of www.ancestry.com. Yet another free site that was very helpful is www.findagrave.com.

With all of these sites, you have to keep in mind that some of these records can be a little inaccurate with misspellings of names. In addition, back in the days of when the census people came around and beat on the door, then took down what you told them and wrote it on a piece of paper. A lot of times, the people being questioned didn't want to give the government their full names, so they would just say R.M. Allison, instead of Richard Mark Allison, for example.

Also, on the Find a Grave site, there are these wonderful people who go through cemeteries and take pictures of the graves. Sometimes, they are family descendants and sometimes they are not. They may not know that another relative who died might be in a different cemetery and the link is missing from Find a Grave. I know in my own search, a lot of times the parents would be listed with some of their children, but not all of them. This could be because they are still alive, or it could be that the person who put the information on Find a Grave didn't know that there was more children.

Anyway, I was able to find the first Allison male to come to America who was born in 1675 in Londonderry, Northern Ireland. After that, I was able to trace the family tree all the way down to me. It was an arduous task, but it has been well worth the effort. That black hole that I had is filled in a little bit now.

I discussed doing genealogical research in my book, Meet Wally Street. The Reason You're Stupid as being a good thing to do if you are retired and bored to tears. If you need any pointers or tips, then don't hesitate to ask me.

There are several sources on the Internet where you can get information, but most of them charge you money every month. Personally, I am not a big fan of paying for information when I might be able to find it for free. There are some free sites that I used to gather the information. One of them is www.familysearch.org and another is www.rootsweb.com which is the free side of www.ancestry.com. Yet another free site that was very helpful is www.findagrave.com.

With all of these sites, you have to keep in mind that some of these records can be a little inaccurate with misspellings of names. In addition, back in the days of when the census people came around and beat on the door, then took down what you told them and wrote it on a piece of paper. A lot of times, the people being questioned didn't want to give the government their full names, so they would just say R.M. Allison, instead of Richard Mark Allison, for example.

Also, on the Find a Grave site, there are these wonderful people who go through cemeteries and take pictures of the graves. Sometimes, they are family descendants and sometimes they are not. They may not know that another relative who died might be in a different cemetery and the link is missing from Find a Grave. I know in my own search, a lot of times the parents would be listed with some of their children, but not all of them. This could be because they are still alive, or it could be that the person who put the information on Find a Grave didn't know that there was more children.

Anyway, I was able to find the first Allison male to come to America who was born in 1675 in Londonderry, Northern Ireland. After that, I was able to trace the family tree all the way down to me. It was an arduous task, but it has been well worth the effort. That black hole that I had is filled in a little bit now.

I discussed doing genealogical research in my book, Meet Wally Street. The Reason You're Stupid as being a good thing to do if you are retired and bored to tears. If you need any pointers or tips, then don't hesitate to ask me.

Friday, July 11, 2014

All Good Things Must Come to an End

This is an opinion blog and today I am giving my opinion based on my own experience of writing a book. When I wrote my book, Meet Wally Street, I did it with a company owned in some manner by Amazon. I wanted to be able to offer it both in print and as an eBook on the Kindle. At the time, I'll admit that I was a little green about self-publishing. Luckily however, I stumbled across the eBook publisher Smashwords. Smashwords is a company that promotes independent authors like me. They have eBook publishing relationships with Apple, Barnes & Noble and a host of other companies, in addition to selling eBooks themselves.

After I came across Smashwords, I realized what a great American business idea that Mark Coker, the founder had come up with. For someone relatively unknown as an author like myself, there is almost no possible way to get a large publishing house to agree to publish my book. Only the really famous authors get those opportunities. However, this exclusivity is now turning against these big publishing houses. They have a major and I do mean major problem. Authors like me and others want our books to be published and also we want to be able to set our own pricing. With the large publishing houses, this was not possible. Now, however it is thanks to Smashwords.

Smashwords has given me all the tools necessary to sell my book across multiple eBook retailers. They also make it easy to put my eBook on any computer, phone, tablet or other reading device. Mark Coker realized early on that by making arrangements with Apple, Barnes & Noble and others, he could help any and I do mean any author publish their eBook and have it for sale on the top eBook retailer sites. This was a brilliant decision.

Not long after I hit the button with Amazon, I discovered that Amazon wants to try and force you into exclusivity with only their firm and their Kindle Select program. As an author, I want to have my book on Apple iBooks or Barnes & Noble's Nook, too. Amazon however tries to get authors to agree to exclusivity. In fact, I agreed to it before I realized what a bad deal it was for me. I had to wait 60 days for that to expire, then I moved full bore with Smashwords. Now my eBook is pretty much available everywhere.

The large publishing houses would not allow me to give away my eBook for free if I wanted to, but Smashwords will. The large publishing houses will not let me offer discount coupons that can be tracked to specific sales, but Smashwords will. The large publishing houses are going to become much smaller and there will be a lot of consolidation, because they have failed to adapt to a changing marketplace. They are going to find it tough to survive.

This is the way these publishers work today. Suppose you are one of the lucky authors who has a large publisher agree to market your book nationwide at the major bookstores. You basically have two or three weeks in these bookstores to sell your new book. If it doesn't sell, then the bookstores can send them back to the publisher without having to pay anything for the books that didn't sell. As an author, even a well known author, you get two or three weeks. Further, if you as the author want your book to sell, then you have to make the rounds. Get on television, do radio interviews and be interviewed for print publications. All of this needs to happen fast and in concert with your book release. There is a lot of time commitment and cost to doing this without any guarantee of success.

With Smashwords, my book is available for as long as I want it to be for sale. Now from the author's point of view, which is better for the author? Do you see why these publishers are in trouble? That arrogant attitude of turning down author after author over the years is coming back to bite them. Oh don't get me wrong. You will still be able to buy hardcover and paperback books. It will just not be as large a market as eBooks. After all, you can keep a ton of eBooks on your iPad, Nook or Kindle as opposed to a book shelf in your house.

The eBook market is exploding with growth. As more and more authors use Smashwords, and trust me, they are spitting out a bunch of new eBooks everyday, then you will find that Smashwords is liable to be the dominant player in the eBook marketplace for authors. Their growth is astounding and I highly recommend them for any author, even the popular ones.

Pretty soon, you will see hardback books at the antique store instead of Barnes & Noble. Mark my word on it.

By the way, Meet Wally Street, The Reason You're Stupid is only available for FREE for about one more week. After that, I am jacking the price all the way up to $3.99. All good things must come to an end.

After I came across Smashwords, I realized what a great American business idea that Mark Coker, the founder had come up with. For someone relatively unknown as an author like myself, there is almost no possible way to get a large publishing house to agree to publish my book. Only the really famous authors get those opportunities. However, this exclusivity is now turning against these big publishing houses. They have a major and I do mean major problem. Authors like me and others want our books to be published and also we want to be able to set our own pricing. With the large publishing houses, this was not possible. Now, however it is thanks to Smashwords.

Smashwords has given me all the tools necessary to sell my book across multiple eBook retailers. They also make it easy to put my eBook on any computer, phone, tablet or other reading device. Mark Coker realized early on that by making arrangements with Apple, Barnes & Noble and others, he could help any and I do mean any author publish their eBook and have it for sale on the top eBook retailer sites. This was a brilliant decision.

Not long after I hit the button with Amazon, I discovered that Amazon wants to try and force you into exclusivity with only their firm and their Kindle Select program. As an author, I want to have my book on Apple iBooks or Barnes & Noble's Nook, too. Amazon however tries to get authors to agree to exclusivity. In fact, I agreed to it before I realized what a bad deal it was for me. I had to wait 60 days for that to expire, then I moved full bore with Smashwords. Now my eBook is pretty much available everywhere.

The large publishing houses would not allow me to give away my eBook for free if I wanted to, but Smashwords will. The large publishing houses will not let me offer discount coupons that can be tracked to specific sales, but Smashwords will. The large publishing houses are going to become much smaller and there will be a lot of consolidation, because they have failed to adapt to a changing marketplace. They are going to find it tough to survive.

This is the way these publishers work today. Suppose you are one of the lucky authors who has a large publisher agree to market your book nationwide at the major bookstores. You basically have two or three weeks in these bookstores to sell your new book. If it doesn't sell, then the bookstores can send them back to the publisher without having to pay anything for the books that didn't sell. As an author, even a well known author, you get two or three weeks. Further, if you as the author want your book to sell, then you have to make the rounds. Get on television, do radio interviews and be interviewed for print publications. All of this needs to happen fast and in concert with your book release. There is a lot of time commitment and cost to doing this without any guarantee of success.

With Smashwords, my book is available for as long as I want it to be for sale. Now from the author's point of view, which is better for the author? Do you see why these publishers are in trouble? That arrogant attitude of turning down author after author over the years is coming back to bite them. Oh don't get me wrong. You will still be able to buy hardcover and paperback books. It will just not be as large a market as eBooks. After all, you can keep a ton of eBooks on your iPad, Nook or Kindle as opposed to a book shelf in your house.

The eBook market is exploding with growth. As more and more authors use Smashwords, and trust me, they are spitting out a bunch of new eBooks everyday, then you will find that Smashwords is liable to be the dominant player in the eBook marketplace for authors. Their growth is astounding and I highly recommend them for any author, even the popular ones.

Pretty soon, you will see hardback books at the antique store instead of Barnes & Noble. Mark my word on it.

By the way, Meet Wally Street, The Reason You're Stupid is only available for FREE for about one more week. After that, I am jacking the price all the way up to $3.99. All good things must come to an end.

Friday, May 30, 2014

In Relation to What?

Anytime that you are looking at the management of your portfolio you want to take a macro view. When you take a micro view, then this is when you get in trouble. For example, let's say you invested some money two years ago. You put a lot of thought into it and invested in a portfolio of investments which could be stocks, bonds, mutual funds, or ETF's. You have completed only one small aspect of the job.

Portfolio management is an ongoing process of research, comparison, evaluation, selling decisions, replacement buying decisions and big picture thinking. What benchmark are you using to compare your portfolio against? What expected level of return are you seeking? What type of risk and volatility are you willing to stomach? How are you going to manage your investment expenses?

Just making the buy decisions in the beginning is only a smidgeon of the portfolio management process. There is constant work to be done along the way.

Occasionally, I meet someone who picks out a time period that has a good return and then they set their expectations at that level. This is a mistake. In fact, investment performance should not be your focus at all. You probably think I am crazy for saying this, but I can prove it to you.

If you invest in an index mutual fund or ETF like the S&P 500 for example, then you will receive the performance of the S&P 500 minus the expenses and the generally miniscule tracking error of the mutual fund or ETF. That's a fact Jack! So, this begs the question, why should you be concerned with the performance of such a mutual fund or ETF if you know it is going to closely track the S&P 500? The truth is that you shouldn't be concerned at all about this particular investment from a performance standpoint. You will get the performance you seek.

On the other hand, if you bought a pool of stocks, or some actively managed mutual funds, then you have a problem. You have just made your life more complicated for one thing. For another thing, now you have to worry about that pool of stocks, or actively managed mutual funds. Is it going to fail to out perform the benchmark? Oh, by the way, what is your benchmark for a pool of stocks or actively managed mutual funds? How will you penalize yourself for failing to meet a benchmark? I doubt very seriously that you would fire yourself, if you failed at meeting a portfolio benchmark, even if you had one in the first place.

Let's take a pool of actively managed stocks, for example. How many stocks are in this pool? Is is 10? 20? 30? or 40? What is the right number? How much are the trading costs going to be? How often will you re-balance? What sectors of the economy are included in your pool of stocks? Did you cover all the major sectors of the economy? What sub-sectors do you have in your pool? Are your stocks value stocks, or are they growth stocks? Are your stocks large company, mid-cap companies, small cap companies, micro stocks or international stocks? Then, once you know what size they are, then again, are they value, or growth tilted? What percentages do you weight towards each stock? Should large company have more than international? Should small cap have more than mid-cap?

Drilling down some more, we want to know how each of these stocks act in a recessionary time period? What can we expect when the market declines? Do these stocks pay dividends? Are we reaching for dividend yields like with preferred stocks that put our portfolio at greater risk? How do they act when the market is doing well? Are we missing out on returns because we are in the wrong stocks? Are we missing out on returns because we are not in the right sectors and sub-sectors? Are we trading too much?

I haven't even covered the statistical aspect of this pool of stocks like what is the beta, alpha, sharp ratio, R squared and other statistical figures that are very, very important to know. Most investors have no idea what any of these are, but they fail to know at their own peril. Yet, people think when they make the decision to buy a pool of stocks, then they can just sit back and watch their money grow. Wrong. There is a whole lot of work that must be done to stay on top of things.

Performance is something to worry about if you are actively managing a portfolio of stocks or actively managed mutual funds. It is nothing to worry about if you are investing in passively managed, low expense index funds or ETF's, because you know that you will get the performance of the index. You see this major difference? It is a huge difference. Believe me when I tell you.

Investors who are actively managing their own portfolios in a bull market fancy themselves as "talented" money managers. Here is the grim reality. When the market goes down, your "talent" goes out the window. You will then realize that this money management stuff is a little harder than you thought. Don't be so proud of yourself when investing in a bull market. Any one can have success by throwing darts at the Wall Street Journal and investing those stocks. It takes more to be a professional. As a professional, I moved all of our clients to cash on October 6, 2008. Do you or your advisor do that? I doubt it. Did they stay in cash until May of 2009? I doubt that also. What is the difference? I am a professional with years and years of money management experiences.

If you picked 40 stocks and diversified them across all the major sectors of the economy, then guess what? You have built yourself your own mutual fund per se that is going to track the S&P 500. Congratulations! Oh, did you know that you could have just bought an S&P 500 indexed mutual fund or ETF and saved yourself a whole lot of headaches? This is the scenario if your pool of stocks performs as it should based on the sectors of the economy that each of those stocks are in. You will simply build your own mutual fund. It's kind of silly, don't you think? It is silly to put all that time and effort into building and managing a pool of stocks when you could have just purchased a passively managed S&P 500 index fund instead. Are you getting the picture now?

What if your actively managed pool of stocks under performs? Uh-oh! Now you are losing money compared to a passively managed S&P 500 index mutual fund or ETF. This not good.

I cannot tell you how many times I see people want to hold onto a small group of stocks, like 3 or 4, for sentimental or emotional reasons. If those 3 or 4 stocks make up more than 30% of your overall portfolio, then your results will be skewed by what those stocks do. Most times, they are crappy stocks or big name stocks where their major growth years are behind them. Look at your account statement. You know that what I am telling you is right. You are sitting there with a bunch of crappy stocks in your portfolio that needs cleaning up. Yet, you are not engaged to do anything about it. That is foolish.

If performance is your main focus, then I would ask a question. In relation to what? I know my plan, process and professionalism is well thought out. Is yours? Quit being so disengaged with your money. Hire a professional with (the three P's) a plan, a process and who is a professional.

Oh, by the way, I am available.

Did you read my book, Meet Wally Street. The Reason You're Stupid? Click the link in the upper right column to buy it at your favorite eBook retailer. Trust me. It is worth all three dollars and ninety-nine cents.

Portfolio management is an ongoing process of research, comparison, evaluation, selling decisions, replacement buying decisions and big picture thinking. What benchmark are you using to compare your portfolio against? What expected level of return are you seeking? What type of risk and volatility are you willing to stomach? How are you going to manage your investment expenses?

Just making the buy decisions in the beginning is only a smidgeon of the portfolio management process. There is constant work to be done along the way.

Occasionally, I meet someone who picks out a time period that has a good return and then they set their expectations at that level. This is a mistake. In fact, investment performance should not be your focus at all. You probably think I am crazy for saying this, but I can prove it to you.

If you invest in an index mutual fund or ETF like the S&P 500 for example, then you will receive the performance of the S&P 500 minus the expenses and the generally miniscule tracking error of the mutual fund or ETF. That's a fact Jack! So, this begs the question, why should you be concerned with the performance of such a mutual fund or ETF if you know it is going to closely track the S&P 500? The truth is that you shouldn't be concerned at all about this particular investment from a performance standpoint. You will get the performance you seek.

On the other hand, if you bought a pool of stocks, or some actively managed mutual funds, then you have a problem. You have just made your life more complicated for one thing. For another thing, now you have to worry about that pool of stocks, or actively managed mutual funds. Is it going to fail to out perform the benchmark? Oh, by the way, what is your benchmark for a pool of stocks or actively managed mutual funds? How will you penalize yourself for failing to meet a benchmark? I doubt very seriously that you would fire yourself, if you failed at meeting a portfolio benchmark, even if you had one in the first place.

Let's take a pool of actively managed stocks, for example. How many stocks are in this pool? Is is 10? 20? 30? or 40? What is the right number? How much are the trading costs going to be? How often will you re-balance? What sectors of the economy are included in your pool of stocks? Did you cover all the major sectors of the economy? What sub-sectors do you have in your pool? Are your stocks value stocks, or are they growth stocks? Are your stocks large company, mid-cap companies, small cap companies, micro stocks or international stocks? Then, once you know what size they are, then again, are they value, or growth tilted? What percentages do you weight towards each stock? Should large company have more than international? Should small cap have more than mid-cap?

Drilling down some more, we want to know how each of these stocks act in a recessionary time period? What can we expect when the market declines? Do these stocks pay dividends? Are we reaching for dividend yields like with preferred stocks that put our portfolio at greater risk? How do they act when the market is doing well? Are we missing out on returns because we are in the wrong stocks? Are we missing out on returns because we are not in the right sectors and sub-sectors? Are we trading too much?

I haven't even covered the statistical aspect of this pool of stocks like what is the beta, alpha, sharp ratio, R squared and other statistical figures that are very, very important to know. Most investors have no idea what any of these are, but they fail to know at their own peril. Yet, people think when they make the decision to buy a pool of stocks, then they can just sit back and watch their money grow. Wrong. There is a whole lot of work that must be done to stay on top of things.

Performance is something to worry about if you are actively managing a portfolio of stocks or actively managed mutual funds. It is nothing to worry about if you are investing in passively managed, low expense index funds or ETF's, because you know that you will get the performance of the index. You see this major difference? It is a huge difference. Believe me when I tell you.

Investors who are actively managing their own portfolios in a bull market fancy themselves as "talented" money managers. Here is the grim reality. When the market goes down, your "talent" goes out the window. You will then realize that this money management stuff is a little harder than you thought. Don't be so proud of yourself when investing in a bull market. Any one can have success by throwing darts at the Wall Street Journal and investing those stocks. It takes more to be a professional. As a professional, I moved all of our clients to cash on October 6, 2008. Do you or your advisor do that? I doubt it. Did they stay in cash until May of 2009? I doubt that also. What is the difference? I am a professional with years and years of money management experiences.

If you picked 40 stocks and diversified them across all the major sectors of the economy, then guess what? You have built yourself your own mutual fund per se that is going to track the S&P 500. Congratulations! Oh, did you know that you could have just bought an S&P 500 indexed mutual fund or ETF and saved yourself a whole lot of headaches? This is the scenario if your pool of stocks performs as it should based on the sectors of the economy that each of those stocks are in. You will simply build your own mutual fund. It's kind of silly, don't you think? It is silly to put all that time and effort into building and managing a pool of stocks when you could have just purchased a passively managed S&P 500 index fund instead. Are you getting the picture now?

What if your actively managed pool of stocks under performs? Uh-oh! Now you are losing money compared to a passively managed S&P 500 index mutual fund or ETF. This not good.

I cannot tell you how many times I see people want to hold onto a small group of stocks, like 3 or 4, for sentimental or emotional reasons. If those 3 or 4 stocks make up more than 30% of your overall portfolio, then your results will be skewed by what those stocks do. Most times, they are crappy stocks or big name stocks where their major growth years are behind them. Look at your account statement. You know that what I am telling you is right. You are sitting there with a bunch of crappy stocks in your portfolio that needs cleaning up. Yet, you are not engaged to do anything about it. That is foolish.

If performance is your main focus, then I would ask a question. In relation to what? I know my plan, process and professionalism is well thought out. Is yours? Quit being so disengaged with your money. Hire a professional with (the three P's) a plan, a process and who is a professional.

Oh, by the way, I am available.

Did you read my book, Meet Wally Street. The Reason You're Stupid? Click the link in the upper right column to buy it at your favorite eBook retailer. Trust me. It is worth all three dollars and ninety-nine cents.

Tuesday, May 6, 2014

Crowd Funding and Rule 506(c)

I devoted a little bit of my book, Meet Wally Street. The Reason You're Stupid to Private Placements and Regulation D offerings. One of the main points that I wanted to get across is that you really have to keep your radar up when you are approached by people who want you to invest in their Regulation D offering.

As I mentioned in my book, there are several different ways for companies to raise money. Depending on the particular IRS Code Section, you might be able to raise $1,000,000, $5,000,000 or an unlimited amount from mostly accredited investors and a limited number of non-accredited investors.

The crowd funding people got out ahead of the regulators, specifically the SEC and were raising money without fully understanding the regulations. As a result, Congress passed a law, The JOBS Act of 2012 that basically allows crowd funding to continue. The crowd funding people were using the Internet and social media to raise funds for their ventures. However, it wasn't until The JOBS Act was passed and the SEC in turn in established a new rule named 506(c) that they were officially allowed to advertise their offerings. The private placements under this new rule 506(c) had to be made to only accredited investors. No non-accredited investors are allowed to participate in their offering on exempt securities.

The full details of the rule have not been fully implemented as the SEC is continuing to develop the final rule. They did however allow the rule 506(c) to go ahead. One of the things in the rule was that the issuer (the people promoting it and who want you to invest in it) had to "verify" that each investor was indeed an accredited investor. Well, what does "verify" mean as far as the SEC is concerned?

Verify means prove it with tax returns, bank statements, W-2's, 1099's, K-1's and the like. There is another way to "verify" a person or entity to be an accredited investor. You can obtain a written letter from a registered broker-dealer or an SEC registered investment adviser (RIA) to attest to the fact. As an alternative, you can also get an licensed attorney or a CPA to attest to the fact that you are an accredited investor. Some people are saying this is a little too much of a gray area. They rightly point out that the broker-dealer, SEC RIA, attorney or CPA would have an opportunity to fudge a little on the letter by saying someone is accredited when in fact they are not. Of course, I am not saying that all of these professionals would do this, but it leaves it open for conflicts of interest. For example, what if the issuer tells you this:

"If your attorney will not sign off on you being an accredited investor, then ours will."

Keep in mind that these people hawking these rule 506(c) Private Placements will exaggerate the merits of their offering, because they want your money. Some will say anything to get you to invest and if they are unscrupulous, they may "help" you get "verified" so you can invest. Now, I am not saying all these people are crooks or anything, but it certainly is a little bit of a gray area in my mind.

Recently, I came across one of these fresh and new 506(c) Private Placements.This particular one was in simplistic terms a Non-Publicly Traded REIT. As I mention in my book, there are plenty of Publicly Traded REIT's that you can buy any day of the week on the NYSE with full liquidity where you can get to your money in as little as three days. Conversely, these 506(c) REIT's are not liquid and in my opinion, are designed to benefit the issuer's executives above all else.

After a diligent review of rule 506(c), I was surprised to learn that you need no type of licensing whatsoever to offer this Private Placement. You would think that a REIT might have someone on the executive committee who is advising them from a securities perspective like a registered broker-dealer firm. You would be wrong, because it is optional. They can have a brokerage firm involved if they want to, but it is not necessary. Normally, you want a brokerage firm involved, because the brokerage firm tells all of their registered representatives to promote the offering to their customers. So, if they decide to fore go the use of a brokerage firm, then they are going to be relying more on advertising, seminars, web sites and social media to promote their rule 506(c) Private Placements.

The other thing that I noticed is that none of the executives have any real estate licenses. You would think people who are selling a Non-Publicly Traded REIT via rule 506(c) would have someone with a real estate license. At least I would think that way. This particular group not only did not have any real estate licenses, but they did not have any securities licenses either. Does that scare you a little bit? It does me.

It is difficult for most investors to find, but you can find information on the executives and their offering. It is much harder if they do not have any licenses. I was able to dig deep and find out that this particular Non-Publicly Traded 506(c) Private Placement was previously offered through a registered broker-dealer. Interesting. Once I found the brokerage firm, then I was able to pull up their information. Much to my chagrin, they had their broker-dealer licensed revoked. Revoked? Yes, revoked. That made me dig even deeper to find out why they got their broker-dealer license revoked. It turns out that this broker-dealer got their license revoked for misleading people about Non-Publicly Traded REIT's they offered. Whoa Nelly!

The first offer of this Non-Publicly Traded REIT was offered pre-rule 506(c). They had to use a broker-dealer the first time. Fast forward a couple of years and now because of rule 506(c), they do not need a broker-dealer. Who can blame them after their first experience with the now revoked brokerage firm?

Now, when I look at this I see a company promoting a Non-Publicly Traded REIT via rule 506(c) without a broker-dealer, without a SEC registered investment adviser, without any licenses of any type and wonder if the accredited investors did their homework like I did. I seriously doubt it.

So, what is an accredited investor to do if they want to "verify" the issuer or people promoting this offering? Full disclosure here as I have no financial incentive or involvement with this firm, but there is a firm called Crowd Check that runs a background check on the issuer and its executives for a fee. To me, it would be worth the fee to have this done if you are real serious about investing in a particular Private Placement. Their web site is http://www.crowdcheck.com. They have lots of great information about all the different Regulation D Private Placement rules. In addition, they think like I do. Their goal is to protect investors.

As for me, I am going to stick with the advice in my book. Never invest in a Private Placement in the first place and you will be better off. Why do you want to invest in something that is totally illiquid and has restrictions against selling, requires you to hold it for several years, if not a decade and you have to hope that you get your money back, not to mention with interest? Why would you invest in such a thing as a rule 506(c) especially when you can invest in liquid investments and not take those risks?

Of course, this particular rule 506(c) Private Placement that I reviewed will have no trouble finding accredited investors to plop down their hard earned money. We will see in about ten years how they did. My guess is it will be not so good.

Be careful out there. More rule 506(c) Private Placements are coming and you will hear about them, believe me. Hopefully, you will not be easily swayed by all their hype.

As I mentioned in my book, there are several different ways for companies to raise money. Depending on the particular IRS Code Section, you might be able to raise $1,000,000, $5,000,000 or an unlimited amount from mostly accredited investors and a limited number of non-accredited investors.

The crowd funding people got out ahead of the regulators, specifically the SEC and were raising money without fully understanding the regulations. As a result, Congress passed a law, The JOBS Act of 2012 that basically allows crowd funding to continue. The crowd funding people were using the Internet and social media to raise funds for their ventures. However, it wasn't until The JOBS Act was passed and the SEC in turn in established a new rule named 506(c) that they were officially allowed to advertise their offerings. The private placements under this new rule 506(c) had to be made to only accredited investors. No non-accredited investors are allowed to participate in their offering on exempt securities.

The full details of the rule have not been fully implemented as the SEC is continuing to develop the final rule. They did however allow the rule 506(c) to go ahead. One of the things in the rule was that the issuer (the people promoting it and who want you to invest in it) had to "verify" that each investor was indeed an accredited investor. Well, what does "verify" mean as far as the SEC is concerned?

Verify means prove it with tax returns, bank statements, W-2's, 1099's, K-1's and the like. There is another way to "verify" a person or entity to be an accredited investor. You can obtain a written letter from a registered broker-dealer or an SEC registered investment adviser (RIA) to attest to the fact. As an alternative, you can also get an licensed attorney or a CPA to attest to the fact that you are an accredited investor. Some people are saying this is a little too much of a gray area. They rightly point out that the broker-dealer, SEC RIA, attorney or CPA would have an opportunity to fudge a little on the letter by saying someone is accredited when in fact they are not. Of course, I am not saying that all of these professionals would do this, but it leaves it open for conflicts of interest. For example, what if the issuer tells you this:

"If your attorney will not sign off on you being an accredited investor, then ours will."

Keep in mind that these people hawking these rule 506(c) Private Placements will exaggerate the merits of their offering, because they want your money. Some will say anything to get you to invest and if they are unscrupulous, they may "help" you get "verified" so you can invest. Now, I am not saying all these people are crooks or anything, but it certainly is a little bit of a gray area in my mind.

Recently, I came across one of these fresh and new 506(c) Private Placements.This particular one was in simplistic terms a Non-Publicly Traded REIT. As I mention in my book, there are plenty of Publicly Traded REIT's that you can buy any day of the week on the NYSE with full liquidity where you can get to your money in as little as three days. Conversely, these 506(c) REIT's are not liquid and in my opinion, are designed to benefit the issuer's executives above all else.